Will Trump steal the Fed’s spotlight?

What to look out for today

Companies reporting on Wednesday, 28th January: Microsoft, Meta Platforms, Tesla, IBM, GE Vernova, Corning, ADP, General Dynamics, Otis Worldwide, AT&T, Danaher, Textron, Lennox International, Starbucks, ServiceNow, Fair Isaac, ASML Holding

Key data to move markets today

EU: GfK Consumer Confidence Survey

USA: Fed Interest Rate Decision, Fed Monetary Policy Statement, and FOMC Press Conference

US Stock Indices

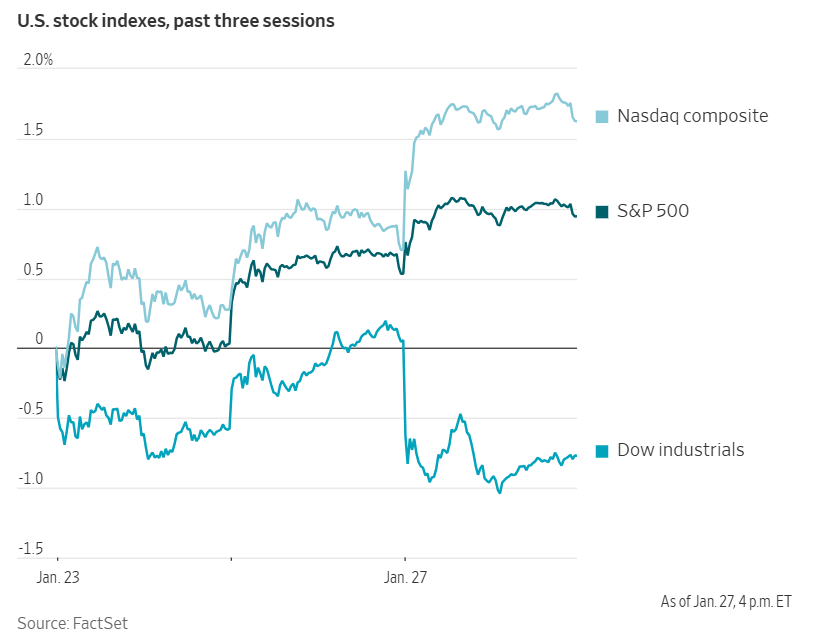

Dow Jones Industrial Average -0.83%

Nasdaq 100 +0.88%

S&P 500 +0.41%, with 9 of the 11 sectors of the S&P 500 up

Health insurance stocks faced significant pressure, weighing on major indices, following news that the Trump administration intends to keep Medicare rates largely unchanged for the coming year.

Collectively, this selloff wiped out approximately $99 billion in market capitalisation across six leading health insurers on Tuesday, according to Dow Jones Market Data.

The Dow Jones Industrial Average declined -0.83%, weighed down primarily by UnitedHealth. In contrast, robust gains in semiconductor stocks supported the Nasdaq Composite and the S&P 500, which advanced +0.91% and +0.41% respectively. The S&P 500 reached its first record high since 12th January.

The Wall Street Journal reported that the Centers for Medicare and Medicaid Services has proposed an average payment rate increase of just 0.09% for next year, substantially below the expectations of both industry participants and analysts. This proposal represents a considerable setback for major health insurers, whose Medicare Advantage plans collectively account for over $500 billion in annual revenue.

In corporate news, United Airlines is intensifying competition with American Airlines by expanding its service by introducing new routes and increasing flight operations from its Chicago hub.

Amazon has announced the closure of its Amazon-branded grocery stores and automated grab-and-go markets, discontinuing two central components of its strategy to establish a stronger presence in physical retail.

The EU has issued Alphabet’s Google a six-month deadline to remove technical obstacles that hinder rival AI search assistants on Android devices and to provide essential data access to competing search engine providers as part of ongoing regulatory measures targeting major technology firms.

Micron Technology plans to invest an additional $24 billion in Singapore over the next decade to enhance its manufacturing capacity.

NextEra Energy is making substantial amounts of power from its nuclear facilities in Wisconsin and New Hampshire available for purchase, as leading technology companies accelerate efforts to secure nuclear energy supplies for their AI data centres.

Lyft is preparing to offer its ridesharing services to teenagers, aligning with a high-demand segment that its larger competitor, Uber Technologies, initially introduced approximately three years ago.

S&P 500 Best performing sector

Information Technology +1.42%, with Corning +15.58%, Lam Research +7.00%, and Amphenol Corporation +6.87%

S&P 500 Worst performing sector

Health Care -1.66%, with Humana -21.13%, UnitedHealth Group -19.61%, and Elevance Health -14.33%

Mega Caps

Alphabet +0.42%, Amazon +2.63%, Apple +1.12%, Meta Platforms +0.09%, Microsoft +2.19%, Nvidia +1.10%, and Tesla -0.99%

Information Technology

Best performer: Corning +15.58%

Worst performer: Roper Technologies -9.64%

Materials and Mining

Best performer: Freeport McMoRan +2.78%

Worst performer: Nucor -2.30%

Corporate Earnings Reports

Posted on Tuesday, 27th January

General Motors quarterly revenue -5.1% to $45.287 bn vs $46.222 bn estimate

EPS at $2.50 vs $2.30 estimate

Mary Barra, Chair and CEO, said, “For several years now, GM’s strong brands and winning vehicles, as well as our technology-driven services and operating discipline, have delivered consistently strong cash generation. This has allowed us to execute all phases of our capital allocation strategy, from investing in the business and our people, to maintaining a strong balance sheet and returning capital to shareholders. We believe that formula is sustainable, which is why we’re increasing our dividend and planning future share repurchases.” — see report.

Northrop Grumman quarterly revenue +9.6% to $11.712 bn vs $11.621 bn estimate

EPS at $7.23 vs $6.98 estimate

Kathy Warden, Chair, CEO and President, said, "We delivered outstanding results in 2025 through strong performance and a laser focus on our customers’ and stakeholders’ highest priorities. Investments in anticipation of our customers’ requirements and ability to deliver differentiating technology at speed and scale position us well to continue to meet the moment for our nation and our partners around the globe. Our record backlog supports our 2026 outlook of mid-single digit sales growth and we are confident in our ability to deliver continued strong performance." — see report.

Boeing quarterly revenue +57.1% to $23.948 bn vs $22.599 bn estimate

EPS at $9.92 vs -$0.44 estimate

Kelly Ortberg, President and CEO, said, “We made significant progress on our recovery in 2025 and have set the foundation to keep our momentum going in the year ahead. We completed the acquisition of Spirit AeroSystems and the sale of portions of the Digital Aviation Solutions business and remain focused on promoting stable operations, completing our development programs, rebuilding trust with our stakeholders, and fully restoring Boeing to the iconic company we all know it can be.” — see report.

European Stock Indices

CAC 40 +0.27%

DAX -0.15%

FTSE 100 +0.58%

Commodities

Gold spot +3.38% to $5,179.40 an ounce

Silver spot +7.92% to $112.14 an ounce

West Texas Intermediate +3.20% to $62.57 a barrel

Brent crude +4.25% to $67.68 a barrel

Gold prices surged to reach a new all-time high on Tuesday due to ongoing economic and geopolitical uncertainties. Spot gold settled +3.8% at $5,179.40 after peaking at $5,181.84 an ounce earlier in the session.

Spot silver advanced +7.92% to $112.14 on Tuesday. It hit a record $117.69 on Monday. Year to date spot silver is +57.36%.

Oil prices closed more than three percent higher on Tuesday, as the aftermath of a severe winter storm significantly disrupted crude production and caused US Gulf Coast crude exports to halt entirely over the weekend.

Brent crude futures increased by $2.76, or +4.25%, to settle at $67.68 per barrel. US WTI crude rose by $1.94, or +3.20%, closing at $62.57 per barrel.

According to estimates from analysts and traders, US oil producers experienced a loss of up to 2 million barrels per day, approximately 15% of the nation’s total output, over the weekend, as the severe winter weather placed immense strain on energy infrastructure and power grids across the country.

The adverse weather conditions have propelled crude futures upward, with short-term risks remaining skewed to the upside due to heightened concerns over potential supply disruptions.

On Sunday, exports of crude oil and liquefied natural gas from US Gulf Coast ports dropped to zero in response to frigid conditions, according to ship tracking service Vortexa. However, export activity rebounded on Monday, with flows exceeding typical seasonal levels as ports resumed operations.

Kazakhstan’s largest oilfield, Tengiz, is projected to restore less than half of its usual production by 7th February, as it gradually recovers from a recent fire and power outage, according to sources familiar with the situation cited by Reuters.

Nevertheless, the Caspian Pipeline Consortium (CPC), which manages Kazakhstan’s primary export pipeline, announced that it had resumed full loading capacity at its terminal on Russia’s Black Sea coast following the completion of maintenance at one of its three mooring points.

Note: As of 4 pm EST 27 January 2026

Currencies

EUR +1.37% to $1.2041

GBP +1.23% to $1.3846

Bitcoin +1.14% to $88,975.23

Ethereum +2.89% to $3,012.18

On Tuesday, the US dollar extended its losses, reaching a near four-year low following remarks from the US President, who stated that the dollar's valuation is ‘great’ when questioned about its recent decline.

"No, I think it's great," President Trump told reporters in Iowa. "I mean, the value of the dollar, look at the business we're doing."

The US President’s comments put further pressure on the dollar, which had already been under strain due to a possible coordinated intervention by Tokyo and Washington.

Additionally, ongoing disagreements between Republicans and Democrats regarding funding for the Department of Homeland Security — exacerbated by the fatal shooting of a second US citizen by federal immigration officers in Minnesota — have heightened concerns about the possibility of another government shutdown.

The dollar index fell by -1.33%, declining to 95.77 and marking its lowest level since February 2022.

The euro appreciated +1.37% to $1.2041, surpassing $1.20 for the first time since June 2021. Similarly, the British pound strengthened by +1.23% to $1.3846, its highest level since September 2021.

It is anticipated that the US President may soon announce his nominee to succeed Fed Chair Jerome Powell, particularly if he disagrees with the FOMC’s policy decision today.

Much of the attention in foreign exchange markets has centred on the Japanese yen, which surged by as much as four percent over the last two sessions amid speculation that US and Japanese authorities are conducting rate checks, a move often seen as a precursor to official market intervention.

On Tuesday, the yen rose +1.28% against the US dollar, trading at ¥152.19.

Fixed Income

US 10-year Treasury +3.3 basis points to 4.250%

German 10-year bund +0.4 basis points to 2.877%

UK 10-year gilt +3.6 basis points to 4.534%

On Tuesday, movements in US Treasury yields were mixed, with yields on longer-dated maturities increasing as investors anticipated an FOMC decision to maintain interest rates at current levels.

Yields continued to edge higher following a subdued auction of $70 billion in five-year Treasury notes, which stood in stark contrast to the robust demand seen at Monday’s two-year note auction.

The five-year notes were issued at a yield of 3.823%, exceeding the anticipated level at the bidding deadline. This outcome suggests that investors required a premium to purchase the notes. The bid-to-cover ratio registered at 2.34x, marginally below the six-auction average of 2.36x.

During afternoon trading, the yield on the US 10-year Treasury note rose +3.3 bps to 4.250%, while the 30-year yield climbed +5.9 bps to 4.863%.

Following the auction, yields on five-year notes increased by +1.2 bps to 3.827%.

The two-year Treasury yield, which is sensitive to shifts in interest rate expectations, declined -0.8 bps, settling at 3.586%.

Investors will be looking to Fed Chair Powell’s press conference today for insights into the future direction of monetary policy. Powell is set to Chair two more Open Market Committee meetings before his chair term ends in May.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 48.5 bps of cuts in 2026, higher than the 46.4 bps priced in the previous week. Fed funds futures traders are now pricing in a 2.8% probability of a 25 bps rate cut at today’s FOMC meeting, down from 5.5% a week ago.

Germany’s 10-year government bond yield was little changed on Tuesday. It had risen for seven-days.

The yield on Germany’s 10-year Bund edged up +0.4 bps to 2.877%, after reaching an intraday peak of 2.907% on Friday.

Germany’s two-year yield, sensitive to policy rate expectations, eased -0.8 bps to 2.103%. On the long end of the curve, the 30-year yield rose +2.1 bps to 3.494%.

According to the finance ministry, Germany’s net borrowing in 2025 was significantly below the level outlined in its budget plan, supported by both reduced expenditures and higher-than-anticipated revenues.

Market volatility has moderated from the levels observed during heightened tensions over Greenland, with investor attention shifting back to ECB policy. Money markets continue to price in a 15% probability of a rate cut by the ECB this summer and approximately a 35% chance of a rate hike by April 2027.

The yield spread between 10-year French government bonds and Bunds widened slightly to 56.0 bps, following a 19-month low of 55.5 bps recorded during Monday’s session.

On Friday, the French government successfully withstood two votes of no-confidence in parliament regarding its decision to expedite the income component of the 2026 budget.

Italy’s 10-year government bond yield rose +0.3 bps to 3.468%. The spread relative to Bunds stood at 59.1 bps, after narrowing to 53.5 bps in mid-January—the lowest point since August 2008.

Note: As of 5 pm EST 27 January 2026

Global Macro Updates

FOMC Preview. The Fed will release the FOMC policy statement at 2:00 pm EST, followed by a press conference with Chair Powell at 2:30 pm EST. The Fed is widely expected to maintain current policy rates, with market participants assigning only approximately a 2.8% probability to a 25 bps rate cut, according to the CME FedWatch tool.

Most sell-side analysts anticipate that the likely pause reflects the Fed’s ongoing data-dependent stance, with minimal changes to the dual mandate since the December meeting. However, economic data has shown greater strength in recent weeks, highlighted by the Citi Economic Surprise Index reaching its highest level since September.

Previews suggest the Fed may upgrade its assessment of current economic conditions in the upcoming policy statement. The statement could potentially omit references to labour market deterioration and instead emphasise the Fed’s attentiveness to risks on both sides, thereby reinforcing the notion that policy remains within the central bank’s estimated neutral range.

Chair Powell is anticipated to face questions regarding political developments, the Cook case, and his future on the Board following the conclusion of his term as Chair (which he is unlikely to address directly). Further commentary is expected concerning the neutral rate, the recent decline in the unemployment rate, trends in housing disinflation, and the impact of tariff-driven inflation.

This meeting also marks the first with the new 2026 voting members: Dallas Fed President Logan and Cleveland Fed President Hammack. They are generally viewed as being more hawkish.

Consumer confidence at the lowest level since 2014. Consumer confidence for January registered at 84.5, notably below the consensus estimate of 91.1 and a significant decline from the revised December reading of 94.2 (previously reported as 89.1). This marks the lowest level of consumer confidence since May 2014, surpassing even the depths experienced during the COVID pandemic.

Perceptions of the labour market deteriorated as only 23.9% of respondents indicated that jobs were ‘plentiful’, a decrease from 27.5% in December. Conversely, 20.8% reported that jobs were ‘hard to get,’ up from 19.1% previously. Consequently, the labour market differential has narrowed to its smallest margin since March 2021.

The Present Situations Index declined by 9.9 points to 113.7, while the Expectations Index fell by 9.5 points to 65.1. Although the average 12-month inflation expectations increased, the median expectation continued to decrease.

The report highlighted that consumers remain generally pessimistic. Concerns about inflation persisted at elevated levels. Additionally, references to tariffs and trade, the labour market, and political issues rose in frequency. There was also an indication that consumers have become more cautious regarding the purchase of major items over the next six months.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

هذه المقالة متاحة لأغراض ملعوماتية فقط، ولا ينبغي اعتبارها عرضًا أو التماسًا لعرض شراء أو بيع أي استثمارات أو خدمات ذات صلة يمكن الإشارة إليها هنا. ينطوي التداول في الأدوات المالية على مخاطر كبيرة من الخسارة وقد لا يكون مناسبًا لجميع المستثمرين. الأداء السابق ليس مؤشرًا موثوقًا به للأداء المستقبلي.