Will gold prices recover?

What to look out for today

Companies reporting on Tuesday, 3rd February: Advanced Micro Devices, Chipotle Mexican Grill, Corteva, Marathon Petroleum, Merck, Mondelez, PayPal, PepsiCo, Pfizer, Super Micro Computer, and Take-Two Interactive Software

Key data to move markets today

EU: French Consumer Price Index, and ECB Bank Lending Survey

USA: JOLTS and Jobs Openings, and speeches by Richmond Fed President Thomas Barkin and Fed Governor Michelle Bowman

CHINA: RatingDog Services PMI

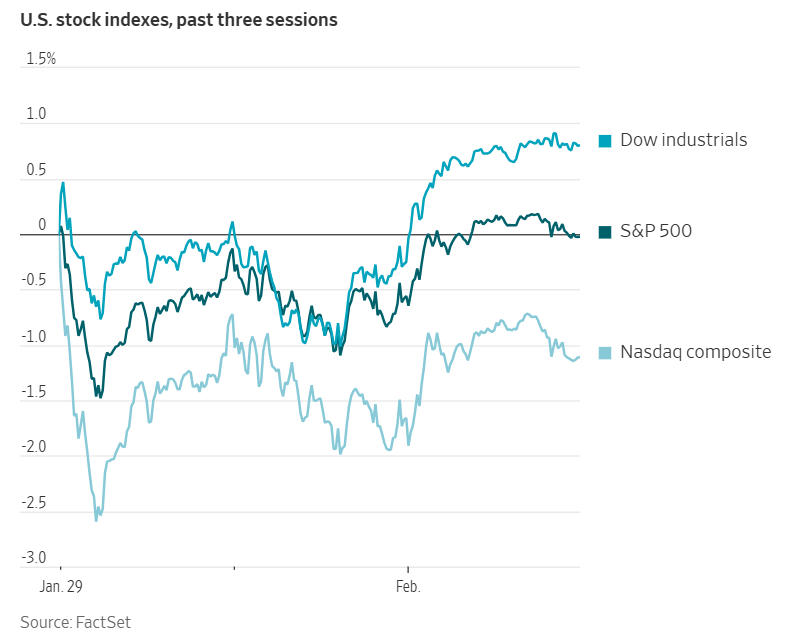

US Stock Indices

Dow Jones Industrial Average +1.05%

Nasdaq 100 +0.73%

S&P 500 +0.54%, with 8 of the 11 sectors of the S&P 500 up

The Dow Jones Industrial Average advanced by over 500 points on Monday, driven by gains in Apple and Caterpillar, as a strong manufacturing reading underscored that the economy is starting the year with momentum.

The blue-chip index closed 515.19 points higher, an increase of +1.05%, reaching 49,407.66—less than 200 points from its all-time high recorded in January. The S&P 500 rose by +0.54%, ending the session less than 0.10% below its historical peak, while the Nasdaq Composite added +0.56%.

In corporate news, Nvidia CEO Jensen Huang clarified that the company’s proposed $100 billion investment in OpenAI had never been a firm commitment, emphasising that any future funding rounds would be evaluated individually. This comes after The Wall Street Journal reported on Friday that Nvidia’s plan to invest up to $100 billion in OpenAI has stalled after some inside the chip giant expressed doubts about the deal.

Elon Musk is reportedly in advanced discussions to merge SpaceX with xAI, reflecting the growing scale of his artificial intelligence pursuits, which have become financially burdensome for any single entity to manage independently.

Vanguard Group has implemented another series of fee reductions across its suite of mutual funds and ETFs, intensifying competition within an industry already distinguished by low costs.

Shares of AstraZeneca, the UK’s largest pharmaceutical company, commenced trading on the New York Stock Exchange on Monday following a listing upgrade, replacing its prior American Depositary Receipts that were listed on Nasdaq.

Eldorado Gold has reached an agreement to acquire copper-focused Foran Mining for C$3.8 billion. This transaction represents the latest in a series of industry consolidations, as mining companies seek to increase metals production in response to a significant price surge over the past year.

Vista Energy, a leading operator in Argentina’s rapidly expanding shale sector, has agreed to purchase oil fields in the Vaca Muerta basin from Equinor.

S&P 500 Best performing sector

Consumer Staples +1.58%, with Walmart +4.13%, Target Corporation +3.85%, and Estee Lauder Companies +3.02%

S&P 500 Worst performing sector

Energy -1.98%, with EQT -5.16%, Coterra Energy -3.60%, and ONEOK -3.58%

Mega Caps

Alphabet +1.88%, Amazon +1.53%, Apple +4.06%, Meta Platforms -1.41%, Microsoft -1.61%, Nvidia -2.89%, and Tesla -2.00%

Information Technology

Best performer: Western Digital Corporation +7.99%

Worst performer: Gartner -3.44%

Materials and Mining

Best performer: Dow +4.83%

Worst performer: CF Industries -3.64%

Corporate Earnings Reports

Posted on Monday, 2nd February

The Walt Disney Co. quarterly revenue +5.23% to $25.981 bn vs $25.697 bn estimate

EPS at $1.63 vs $1.57 estimate

Robert Iger, CEO, said, “We are pleased with the start to our fiscal year, and our achievements reflect the tremendous progress we’ve made. We delivered strong box office performance in calendar year 2025 with billion-dollar hits like Zootopia 2 and Avatar: Fire and Ash, franchises that generate value across many of our businesses. As we continue to manage our company for the future, I am incredibly proud of all that we’ve accomplished over the past three years.” — see report.

Palantir Technologies quarterly revenue +70.0% to $1.407 bn vs $1.407 bn estimate

EPS at $0.25 vs $0.25 estimate

Alexander Karp, Co-founder and CEO, said, "We are at the outset, the very beginning, of a generational project. Our financial results, those crude and imperfect metrics by which a market filled with both excitement and fear attempts to assess the value of the companies it covets, have again exceeded even our most ambitious expectations. We generated $1.4 billion in revenue in the fourth quarter last year, a new record in our twenty-three year history—representing a 70% growth rate over the same period the year before. Such a massive acceleration in growth, for a company of this scale and size, is a remarkable achievement—a cosmic reward of sorts to those who were interested in advancing our admittedly idiosyncratic project and embraced, or at least did not wholly reject, our mode of working." — see report.

Tyson Foods quarterly revenue +5.1% to $14.313 bn vs $14.000 bn estimate

EPS at $0.97 vs $0.95 estimate

Donnie King, President and CEO, said, “Our first quarter results reflect solid execution across our portfolio. Prepared Foods delivered top and bottom-line growth while Chicken reported its fifth consecutive quarter of year-over-year volume gains. As protein demand continues to increase, our consistent share gains demonstrate we are well-positioned to capture this momentum. I'm encouraged by the progress we've made and confident we will drive continued improvement across the controllable aspects of our business in fiscal 2026.” — see report.

European Stock Indices

CAC 40 +0.67%

DAX +1.05%

FTSE 100 +1.15%

Commodities

Gold spot -4.21% to $4,659.44 an ounce

Silver spot -6.39% to $79.21 an ounce

West Texas Intermediate -5.19% to $62.33 a barrel

Brent crude -5.97% to $66.48 a barrel

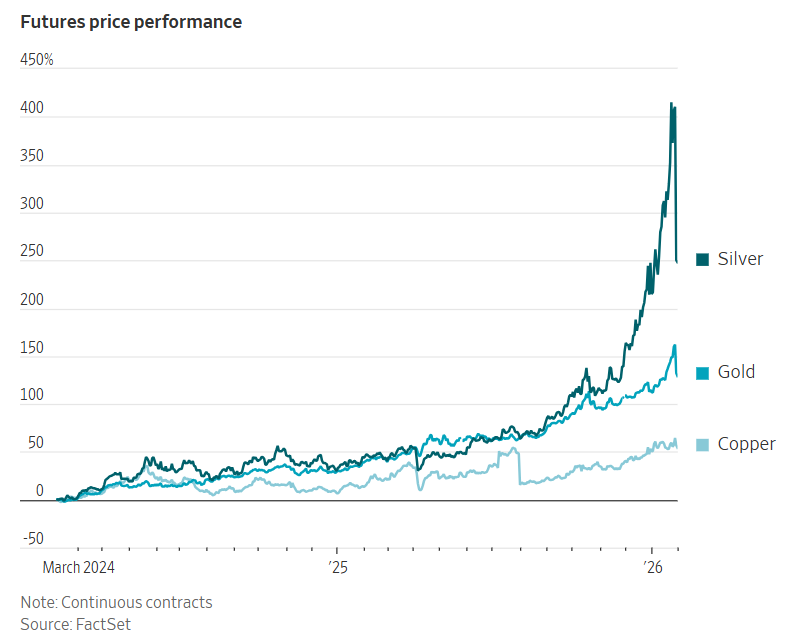

The extraordinary rally in metals prices that captivated both institutional and retail investors came to an abrupt halt on Friday, when silver and gold registered their most significant single-day losses in over forty years.

Silver, a historically volatile and relatively illiquid asset vulnerable to speculative trading and price squeezes, soared to an all-time high of $121.60 per ounce on 29th January. However, it plummeted by 31% the following day, as technical selling and the triggering of stop-loss orders prompted a cascade of sales—the largest one-day decline in LSEG data since 1982.

Its losses continued into Monday, with silver last trading -6.39% lower at $79.21 per ounce, while gold also declined, falling -4.21% to $4,659.44 per ounce. The selloff was exacerbated by the CME’s announcement on 30th January that it would raise margin requirements on precious metal futures, with the changes set to take effect after the market closed on Monday. This policy adjustment accelerated forced selling across both metals.

2026 has witnessed a surge in trading activity for metals options contracts, as well as record trading volumes in leveraged products that contributed to both the rapid ascent and the subsequent dramatic reversal in metals prices.

The period from mid-December to mid-January marked unprecedented retail investor participation, with nearly $1 billion flowing into silver-linked ETFs—the most substantial 30-day inflow on record, as reported by Vanda research. Analysts suggest that trend-following trading programmes and other short-term, high-frequency investors unwinding positions further intensified the volatility and price movements during this period.

Oil prices declined on Monday as market participants considered the potential for a reduction in tensions between the US and Iran, while a stronger US dollar exerted additional downward pressure on prices.

Brent crude futures fell by $4.22, or -5.97%, to settle at $66.48 per barrel. US WTI crude dropped $3.41, or -5.19%, closing at $62.33 per barrel.

The decrease in oil prices followed remarks by the US President, who indicated that Iran was engaged in ‘serious talks’ with Washington, suggesting a possible easing of hostilities with the OPEC member nation.

In addition, Iran and the US officials are scheduled to resume nuclear negotiations on Friday in Turkey.

The pronounced fluctuations in oil prices over recent sessions appear to be driven more by shifts in market sentiment than by fundamental changes. After last week's rally, gains were swiftly reversed as broader risk assets also exhibited heightened volatility.

On the trade front, the US President announced on Monday a new agreement with India that reduces US tariffs on Indian goods to 18% from 50%. In return, India has committed to halting purchases of Russian oil and lowering trade barriers. The agreement was unveiled via social media following a conversation with Indian Prime Minister Narendra Modi, during which it was noted that India would begin purchasing oil from the US and potentially from Venezuela.

Note: As of 4 pm EST 2 February 2026

Currencies

EUR -0.50% to $1.1789

GBP -0.16% to $1.3666

Bitcoin -6.85% to $78,450.59

Ethereum -13.47% to $2,340.56

The US dollar continued to appreciate on Monday, supported by renewed optimism stemming from US manufacturing data that signalled a return to growth. A political impasse in Washington is anticipated to postpone the release of a key labour report scheduled for Friday.

The dollar index advanced +0.40% to 97.53, marking two consecutive days of gains. In comparison, the euro declined by -0.50% to $1.1789, while the yen depreciated by -0.54% to ¥155.59 per dollar.

The British pound registered a modest decrease against the dollar, remaining close to the multi-year high achieved in the previous week as market attention turned toward the upcoming BoE policy announcement on Thursday. Sterling fell -0.16% against the dollar to $1.3666, following its peak of $1.3867 last week, its strongest since September 2021. Against the euro, the pound was relatively stable, trading at 86.61 pence.

Fixed Income

US 10-year Treasury +4.1 basis points to 4.279%

German 10-year bund +2.3 basis points to 2.870%

UK 10-year gilt -2.1 basis points to 4.509%

On Monday, the two-year Treasury yield rose by +5.3 bps to 3.586%, the 10-year yield increased by +4.1 bps to 4.279%, and the 30-year yield advanced by +4.0 bps to 4.915%.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 47.6 bps of cuts in 2026, lower than the 49.1 bps priced in the previous week. Fed funds futures traders are now pricing in a 8.9% probability of a 25 bps rate cut at the 18th March FOMC meeting, down from 16.7% a week ago.

Across the Atlantic, eurozone government bond yields opened the week on a firmer footing, as market participants positioned themselves ahead of an ECB policy decision this week.

In Germany, the 10-year yield advanced by +2.3 bps to 2.870%, while the two-year yield—often regarded as the most responsive to monetary policy expectations—increased by +1.9 bps to 2.099%. At the long end of the curve, the 30-year yield rose +2.1 bps, reaching 3.518%.

Italy’s 10-year government bond yield rose +1.9 bps to 3.485%. The spread relative to Bunds stood at 61.5 bps, after narrowing to 53.5 bps in mid-January—the lowest point since August 2008.

Attention remains focused on the upcoming meeting of the ECB later this week. While the majority consensus anticipates that policy rates will remain unchanged, investors are keenly observing for any indications of how the euro's recent appreciation might influence future monetary policy decisions.

Last week, apprehensions emerged that the strengthening euro could heighten deflationary pressures in the region, potentially prompting the ECB to enact further rate cuts. These concerns contributed to the largest monthly decrease in German two-year yields since April 2025.

US Treasury signals steady note and bond auctions. The US Treasury is widely expected to maintain the size of its note and bond auctions for an eighth consecutive quarter when it announces its financing plans this week. This approach underscores the department’s ongoing strategy of relying more heavily on short-term Treasury bills rather than long-term debt, as it manages a still considerable—though narrowing—fiscal deficit.

Nevertheless, investors will be closely monitoring the announcement for indications regarding future policy—specifically, whether there may be increases in future coupon issuance or potential reductions in long-end supply to support the Trump administration’s objective of lowering long-term borrowing costs.

In its November refunding announcement, the Treasury stated that it has begun to evaluate the possibility of increasing auction sizes for notes and bonds in forthcoming quarters.

On Monday at 3:00 pm ET, the Treasury released its quarterly borrowing projections, followed by the quarterly refunding details at 8:30 am ET on Wednesday. The refunding provides a comprehensive overview of the department’s financing plans for the first and second quarters, including auction sizes for three-year and 10-year notes as well as 30-year bonds.

These financing estimates offer investors greater transparency into the Treasury’s underlying assumptions for April tax receipts—a critical variable influencing near-term funding requirements—and the anticipated trajectory of bill supply. The projections will also clarify the extent to which the Fed’s recent bill purchases are integrated into the overall debt issuance strategy.

In November, the Treasury projected that it would borrow $578 billion during Q1 2026, based on an anticipated cash balance of $850 billion at the end of March.

The Fed’s elevated pace of bill purchases is expected to persist until April, after which a gradual slowdown is anticipated.

However, with the nomination of former Fed Governor Kevin Warsh as the next Fed Chair, the Treasury bill purchase programme may be subject to reassessment, given Warsh’s advocacy for reducing the central bank’s balance sheet.

Another contributing factor to declining US borrowing needs is the projection of smaller-than-expected fiscal deficits for 2025 through 2027, attributed in part to higher-than-anticipated tariff revenues.

Some market observers have questioned whether the Treasury might pursue a more proactive strategy by reducing long-end coupon auction sizes in an effort to lower long-term yields and, by extension, mortgage rates. However, analysts generally consider such a move to be unlikely.

Overall, the Treasury remains committed to meeting its funding requirements primarily through increased issuance of short-term bills, rather than relying on long-term bonds.

By prioritising the issuance of short-term instruments such as Treasury bills, which typically carry lower yields than longer-term debt, the Treasury can secure financing at more favourable rates and minimise immediate interest costs. Treasury Secretary Scott Bessent has emphasised that expanding long-term bond issuance at currently elevated yields would not be cost-effective.

Note: As of 5 pm EST 2 February 2026

Global Macro Updates

Fed’s latest SLOOS highlights tighter C&I lending conditions. According to the Fed’s January Senior Loan Officer Opinion Survey (SLOOS), banks have tightened lending standards for commercial and industrial (C&I) loans across firms of all sizes. Despite these stricter conditions, banks noted an increase in C&I loan demand among large and middle-market firms, while demand from smaller firms remained unchanged.

Commercial real estate (CRE) lending standards were largely unchanged in the fourth quarter, although some larger banks indicated a slight easing of standards. At the same time, banks observed stronger demand for CRE loans, particularly in the nonfarm nonresidential, construction, and land development segments. In contrast, demand for loans related to multifamily properties remained relatively stable.

With respect to household lending, banks reported that standards for residential real estate loans were little changed, though demand weakened across most categories. Auto loan standards continued to ease, while standards for credit cards and other consumer loans remained largely unchanged. Nevertheless, banks cited weaker demand for auto loans and other consumer credit products.

Looking ahead to 2026, banks generally expect lending standards to remain stable across most loan categories. However, they anticipate a broad-based improvement in loan demand. Notably, a significant net share of banks foresee a deterioration in credit quality for credit card and auto loans extended to nonprime borrowers.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

هذه المقالة متاحة لأغراض ملعوماتية فقط، ولا ينبغي اعتبارها عرضًا أو التماسًا لعرض شراء أو بيع أي استثمارات أو خدمات ذات صلة يمكن الإشارة إليها هنا. ينطوي التداول في الأدوات المالية على مخاطر كبيرة من الخسارة وقد لا يكون مناسبًا لجميع المستثمرين. الأداء السابق ليس مؤشرًا موثوقًا به للأداء المستقبلي.