Is the Taikichi trade back?

What to look out for today

Companies reporting on Monday, 9th February: Apollo Global Management, Loews, ON semiconductor, and Principal Financial Group

Key data to move markets today

EU: Sentix Investor Confidence

USA: A speech by Atlanta Fed President Raphael Bostic

US Stock Indices

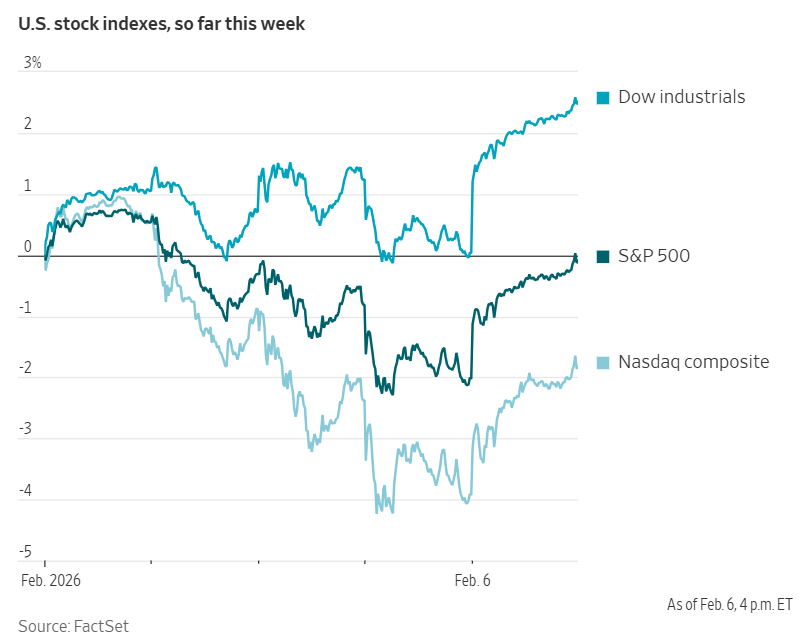

Dow Jones Industrial Average +2.47%

Nasdaq 100 +2.15%

S&P 500 +1.97%, with 9 of the 11 sectors of the S&P 500 up

On Friday, the Dow Jones Industrial Average surpassed the significant milestone of 50,000 points for the first time.

The benchmark index rose by +2.47%, equating to an increase of 1,207 points, thereby establishing a new record at 50,115.67. Of the 30 constituents, all but two recorded gains during the trading session. Following the Dow’s closure above 40,000 in May 2024, it has taken 630 days for the index to reach the 50,000 mark for the first time.

More than 400 companies within the S&P 500 posted increases. Its equal-weighted counterpart, which neutralises the influence of market capitalisation, achieved a record high at 8,188.68 after advancing +1.60% for the week and rising +1.88% on Friday alone.

The Russell 2000 gained +3.60% on Friday, closing at 2,670.34, and contributed to a weekly rise of +1.14%. The Nasdaq 100 also advanced by +2.15% on Friday, but concluded the week down -2.58%.

In corporate news, JPMorgan Chase, Goldman Sachs, and Bank of America have increased their bonus pools for bankers and traders by at least 10%, reflecting a successful year in dealmaking and market activity.

Cboe Global Markets has announced plans to introduce options contracts that will allow binary wagers on event outcomes, thereby entering the rapidly expanding prediction markets sector.

Stellantis NV is facing over €22 billion in charges, primarily due to a strategic shift away from its previous electric vehicle initiatives, which has led to a sharp decline in the value of the shares of the Jeep and Fiat parent company.

BNP Paribas is reportedly considering raising bonuses for its global markets division by nearly 10%, providing traders with some of the largest increases across the organisation, following a record performance by the division.

The EU has issued a warning to ByteDance’s TikTok, urging the company to redesign its platform due to concerns that addictive features may adversely affect the physical and mental wellbeing of its users.

S&P 500 Best performing sector

Information Technology +4.10%, with Super Micro Computer +11.44%, Teradyne +10.69%, and Western Digital +8.61%

S&P 500 Worst performing sector

Communication Services -1.51%, with News Corporation -7.06%, Alphabet -2.48%, and T-Mobile US -2.21%

Mega Caps

Alphabet -2.48%, Amazon -5.55%, Apple +0.80%, Meta Platforms -1.31%, Microsoft +1.90%, Nvidia +7.92%, and Tesla +3.50%

Information Technology

Best performer: Super Micro Computer +11.44%

Worst performer: VeriSign -7.60%

Materials and Mining

Best performer: FMC +7.97%

Worst performer: Linde -2.49%

Corporate Earnings Reports

Posted on Friday, 6th February

Philip Morris International quarterly revenue +6.8% to $10.362 bn vs $10.384 bn estimate

EPS at $1.70 vs $1.70 estimate

Jacek Olczak, CEO, said, “We achieved another remarkable year of results in 2025, with a fifth consecutive year of volume growth, net revenues surpassing $40 billion, including close to $17 billion from our smoke-free business, and very good operating margin expansion. With excellent results in 2024 and 2025, we have delivered our three-year CAGR targets on operating income and EPS in just two years. With another strong performance expected in 2026, we are on track to outperform our 2024-2026 growth algorithm. This again demonstrates our ability to create sustainable value for our shareholders as we renew our growth targets for 2026-2028.” — see report.

European Stock Indices

CAC 40 +0.43%

DAX +0.94%

FTSE 100 +0.59%

Commodities

Gold spot +3.88% to $4,960.39 an ounce

Silver spot +10.08% to $77.98 an ounce

West Texas Intermediate +0.60% to $63.50 a barrel

Brent crude +0.79% to $67.92 a barrel

Gold prices advanced on Friday, recovering from a significant decline in the previous session.

Spot gold increased by +3.88% to reach $4,960.39 per ounce. Spot silver rose by +10.08% to $77.98 per ounce, having previously fallen below the $65 mark during early Asian trading.

On a weekly basis, gold recorded a gain of +1.97%, whereas silver declined by -7.84%.

CME implements third margin increase in two weeks amid market volatility. CME Group has once again increased margin requirements for gold and silver futures contracts, as the world's largest commodities exchange aims to address the risks arising from heightened volatility in the market.

On Thursday, CME Group announced that both initial and maintenance margins for COMEX 100 Gold Futures have been raised to 9%, up from 8% for Non-Heightened Risk Profile (Non-HRP) accounts.

Additionally, initial and maintenance margins for COMEX 5000 Silver Futures have been increased to 18% from the previous 15%. These revised rates took effect after the close of business on Friday, 6th February.

Since 13th January, the US exchange operator has determined margins for gold, silver, platinum, and palladium based on a percentage of contract value, rather than a fixed dollar amount.

Following the adoption of this new margin-setting methodology, CME has implemented three margin hikes so far, on 30th January, 2nd February, and last Thursday, 5th February.

Oil prices concluded higher on Friday, reversing earlier losses as market participants expressed concern that the week’s diplomatic discussions between the US and Iran had not succeeded in reducing the risk of military conflict between the two nations.

Brent crude futures settled at $67.92 per barrel, an increase of 53 cents, or +0.79%. Meanwhile, WTI crude rose by 38 cents, or +0.60%, to close at $63.50 per barrel.

Although both benchmarks experienced declines during overnight trading, they subsequently climbed by over $1 per barrel during the US session before moderating gains at settlement.

On a weekly basis, WTI registered a decline of -3.41%, while Brent fell by -3.93%.

The US and Iran engaged in negotiations through Omani mediation in an effort to bridge significant differences concerning Tehran’s nuclear programme.

According to Iranian state television reports on Friday afternoon, the talks had concluded. Iran’s foreign minister indicated that negotiators would return to their respective capitals for further consultations, with discussions set to continue at a later date.

Prior to the discussions, a lack of consensus on the meeting’s agenda contributed to persistent investor anxiety regarding geopolitical risks. Iran preferred to focus exclusively on nuclear issues, whereas the US sought to address Iran’s ballistic missile programme and its support for armed groups in the region.

Any escalation in tensions between the two countries poses the risk of disrupting global oil supply, given that approximately one fifth of the world’s total oil consumption is transported through the Strait of Hormuz.

In addition, Saudi Arabia reduced the official selling price of its Arab Light crude for Asian markets for March delivery to a near five-year low on Thursday, marking the fourth consecutive month of price reductions.

Note: As of 4 pm EST 6 February 2026

Currencies

EUR +0.35% to $1.1816

GBP +0.62% to $1.3609

Bitcoin +11.43% to $70,331.52

Ethereum +11.17% to $2,053.02

On Friday, the US dollar retreated from its two-week highs, relinquishing part of its earlier safe-haven gains as risk assets experienced a rebound.

Nonetheless, the dollar remained poised for a weekly advance, paring previous losses against the Japanese yen after US economic data indicated an improvement in consumer sentiment for February, despite ongoing concerns regarding employment and the rising cost of living. The dollar index declined by -0.26% on the day, having earlier reached a two-week peak. Over the course of the week, the US dollar index appreciated by +0.55%, marking its most significant weekly gain since early January.

The Japanese yen endured its steepest weekly decline against the dollar since October, depreciating by -1.58% and thereby erasing the majority of its substantial gains from January, as market participants awaited the outcome of Sunday’s national election. On Friday, the yen weakened by -0.11% to ¥157.20 per US dollar in anticipation of the forthcoming vote.

The euro advanced by +0.35% to $1.1816 following the ECB’s decision to maintain interest rates at current levels on Thursday, as widely anticipated, with officials downplaying the influence of currency shifts on future policy considerations. However, the euro posted a weekly decline of -0.27%.

Sterling appreciated by +0.62% to $1.3609 on Friday, yet recorded its sharpest weekly fall against the US dollar since 27th October, declining by -0.58% over the week.

The BoE also opted to maintain interest rates on Thursday, with the decision reached by a narrow margin. The BoE’s MPC signalled that borrowing costs are likely to decrease, provided that the anticipated decline in inflation is sustained.

Fixed Income

US 10-year Treasury +3.3 basis points to 4.217%

German 10-year bund -0.5 basis points to 2.843%

UK 10-year gilt -5.0 basis points to 4.513%

Yields on the interest-rate-sensitive two-year US Treasury note rebounded from their lowest levels in over three months on Friday, as attention turned to January's highly anticipated employment report, scheduled for release next week.

The release of the January employment figures, now set for Wednesday due to a four-day partial government shutdown that concluded on Tuesday, is forecast to show that employers added 70,000 jobs during the month, according to the median estimate of economists. The unemployment rate is anticipated to remain steady at 4.4%.

On Friday, the two-year Treasury yield, which is closely aligned with expectations for Fed Funds rates, rose by +4.9 bps to 3.510%. Earlier in the week, it had touched 3.426%, its lowest since 17th October.

The yield on the 10-year Treasury note climbed by +3.3 bps to 4.217%, after having dipped to 4.156% — the lowest level since 15th January. At the long end of the curve, the 30-year yield edged up by +0.6 bps to 4.853%.

Over the past week, the yield curve between the two-year and 10-year notes steepened modestly, increasing by 0.8 bps to 70.7 bps.

Throughout the week, yields declined across the curve, the 10-year yield declined by -2.1 bps, the 30-year yield decreased by -2.2 bps, and on the short end, the two-year yield fell by -2.9 bps.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 54.4 bps of cuts in 2026, higher than the 52.9 bps priced in the previous week. Fed funds futures traders are now pricing in a 17.9% probability of a 25 bps rate cut at the 18th March FOMC meeting, up from 13.4% a week ago.

German government bond yields remained largely unchanged on Friday, following an earlier dip to multi-week lows. This stability came in the wake of the ECB's decision to leave interest rates on hold.

The yield on Germany's 10-year government bond was little changed, edging -0.5 bps lower to 2.843%, having previously reached 2.813%—its lowest level since 19th January.

Through January, German two-year government bond yields experienced their largest monthly decline since April. This movement was primarily attributed to investor expectations that the ECB will take into account the deflationary pressures arising from a stronger euro when setting monetary policy.

During the session, Germany’s two-year yield rose by +1.9 bps to 2.093%, after having earlier fallen to 2.046%, its lowest since 3rd December. On the long-end of the maturity spectrum, the 30-year yield advanced by +0.8 bps to 3.512%.

Over the week, the yield on the German 10-year bond declined by -0.4 bps. At the short end, the two-year Schatz increased by +1.3 bps, while at the long end, the 30-year yield advanced by +1.5 bps.

Money markets now reflect an approximate 30% probability of a rate cut in September, an increase from 20% the previous day. Additionally, the implied probability of a rate hike in April 2027 has fallen to 0%, down from 10%.

Italy’s 10-year government bond yield was -0.6 bps lower on the day, closing at 3.468%. For the week, it edged slightly higher by +0.3 bps. The spread over Bunds widened to 62.5 bps, an increase of 0.7 bps from the prior week’s 61.8 basis points.

In France, the 10-year yield spread versus Bunds widened to 61.0 bps, its highest since 23rd January, and 2.6 bps above the previous week’s 58.4 bps, following a +2.2 bps increase in the French OAT 10-year yield last week.

Note: As of 5 pm EST 6 February 2026

Global Macro Updates

Landslide victory for LDP in Japan's lower house election. According to NHK, the Liberal Democratic Party (LDP) secured a resounding victory in Sunday’s lower house election, winning 316 out of 465 seats with all votes counted. This result surpasses both the two-thirds supermajority threshold and the party’s pre-election total of 198 seats. This is the first instance in the post-war era where a single party has achieved a two-thirds majority in the lower house. The Japan Innovation Party (JIP) increased its representation to 36 seats (compared with 34 previously), bringing the coalition’s total to 352 seats.

Among opposition parties, the Centrist Reform Alliance (CRA) secured 49 seats, a sharp decline from its previous total of 167. The Democratic Party for the People (DPP) obtained 28 seats, marginally up from 27. Voter turnout was robust, despite severe snowfall in Tokyo and along the western coast. At 55.68%, including early ballots, it showed a slight decrease from the 55.85% recorded in the 2024 election.

The final outcome exceeded even the optimistic expectations suggested by earlier media surveys, confirming a decisive landslide victory for the LDP. Securing a two-thirds majority enables the LDP to overturn any legislation rejected by the upper house, where the party remains in the minority, and establishes an ‘absolute stable majority’—ensuring both chairmanship and majority representation across all lower house committees. Additionally, the result underscores the dramatic decline of the Centrist Reform Alliance (CRA), signalling increased fragmentation among opposition factions. Komeito departed from the ruling coalition to partner with the Constitutional Democratic Party (CDP), with election candidates required to resign from their established parties to formally join the CRA. At a joint press conference on Monday, CDP leader and former Prime Minister Yoshihiko Noda, alongside Komeito’s Tetsuo Saito, all but announced their resignations.

The Nikkei index surged by as much as 5.68% during Monday's morning session, momentarily surpassing the 57,000 mark for the first time. Although Japan was primed for gains following the strength of the US markets on Friday, investor focus was firmly on the euphoria surrounding the LDP’s historic election triumph. Market breadth was similarly impressive, with approximately 70% of TSE Prime Market constituents registering advances.

Volatility in the foreign exchange market was also notable. While a weaker yen had been widely anticipated, the subsequent reversal appeared to reflect increasing scepticism regarding the likelihood of a consumption tax reduction on food items. In a televised interview on Sunday, Prime Minister Takaichi reiterated her commitment to expediting a review by a bipartisan parliamentary committee, in line with her campaign pledge. However, perceived reluctance to implement such measures prompted comparisons with the TACO dynamic observed in the US, as reported by Nikkei. Although these considerations had alleviated pressure on bond yields last week, Japanese Government Bonds (JGBs) reacted bearishly, particularly in the 10-year tenor, amid renewed concerns over fiscal policy.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

هذه المقالة متاحة لأغراض ملعوماتية فقط، ولا ينبغي اعتبارها عرضًا أو التماسًا لعرض شراء أو بيع أي استثمارات أو خدمات ذات صلة يمكن الإشارة إليها هنا. ينطوي التداول في الأدوات المالية على مخاطر كبيرة من الخسارة وقد لا يكون مناسبًا لجميع المستثمرين. الأداء السابق ليس مؤشرًا موثوقًا به للأداء المستقبلي.