Will the tech rally burn out in Q4?

What to look out for today

Companies reporting on Wednesday, 5th November: Albemarle, AMC Entertainment, Amcor, APA, ARM Holdings, Atmos Energy, CF Industries, Costco Wholesale, Devon Energy, DoorDash, Emerson Electric, Fair Isaac, Fiverr, Humana, Jackson Financial, Lemonade, Lucid Group, McDonald’s, MetLife, Novo Nordisk, Qualcomm, Sempra, Snap Inc., Targa Resources, Texas Pacific Land, The Allstate, TKO Group Holdings, Unity Software

Key data to move markets today

EU: German Factory Orders, Spanish, Italian, French, German and Eurozone HCOB Services and Composite PMIs, Eurozone PPI, and speeches by Bundesbank President Joachim Nagel and Banque de France Governor François Villeroy de Galhau

UK: A speech by BoE Deputy Governor for Financial Stability Sarah Breeden

USA: ADP Employment Change, S&P Global Services and Composite PMIs, ISM Services Employment, New Orders Indices, Prices Paid and PMI

JAPAN: Labour Cash Earnings

US Stock Indices

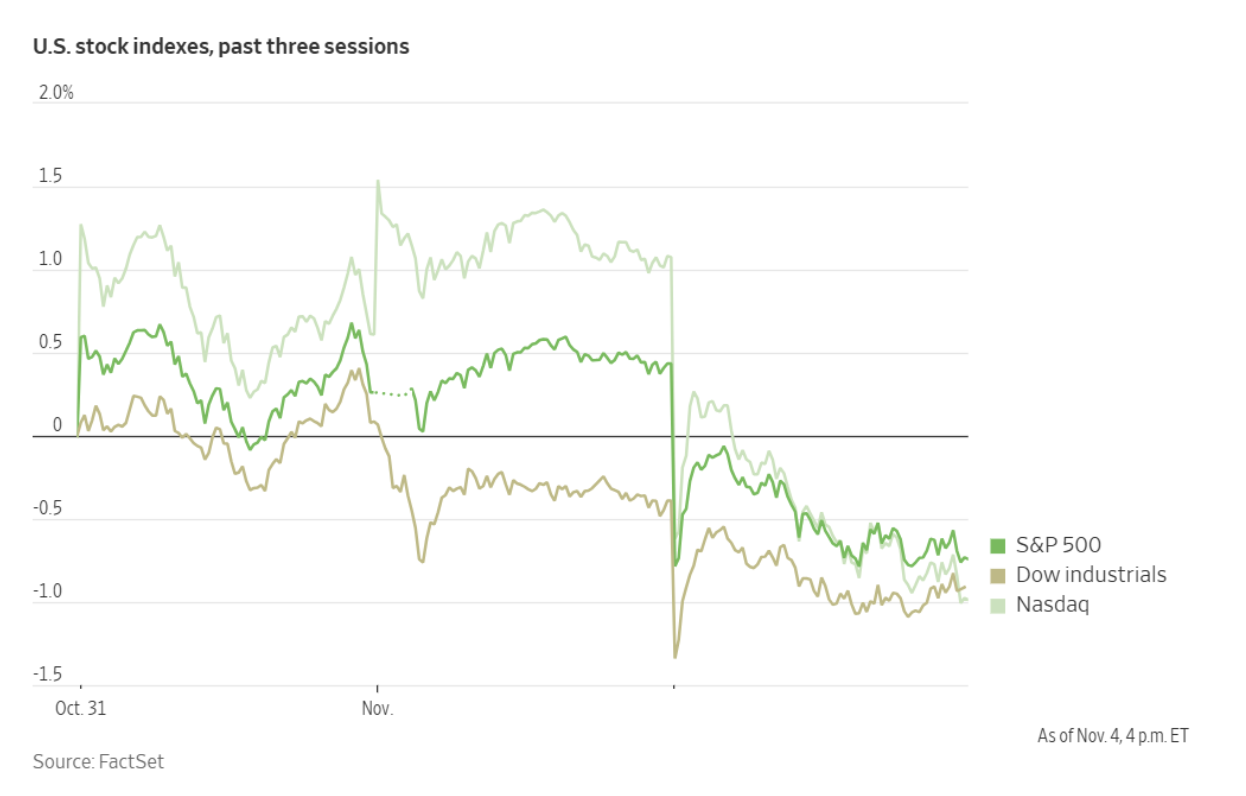

Dow Jones Industrial Average -0.53%

Nasdaq 100 -2.07%

S&P 500 -1.17%, with 7 of the 11 sectors of the S&P 500 down

Market sentiment became increasingly cautious Tuesday. Equity markets declined with the technology-focused Nasdaq Composite leading the retreat. The VIX index rose sharply, signalling heightened volatility. The Nasdaq Composite was -2.04%, the Dow Jones Industrial Average declined 251 points, finishing the session -0.53%, and the S&P 500 fell -1.17%.

Speaking at the Global Financial Leaders’ Investment Summit 2025 hosted by the Hong Kong Monetary Authority, Morgan Stanley CEO Ted Pick cautioned that the recent streak of gains has left equities susceptible to a correction. Key concerns include escalating trade tensions, signs of speculative excess, and emerging challenges within credit markets. While corporate earnings continue to demonstrate resilience, elevated valuations are prompting increased scrutiny.

In corporate news, Apple is preparing to enter the low-cost laptop sector by developing a budget Mac to target consumers who typically opt for Chromebooks and entry-level Windows PCs.

WhatsApp, owned by Meta Platforms, has launched a standalone application for Apple Watch, allowing users to interact with their messages directly from the smartwatch, independent of an iPhone.

Amazon has issued a cease-and-desist letter to Perplexity AI, instructing the artificial intelligence search startup to prevent its browser agent, Comet, from making online purchases on behalf of users.

IBM announced plans to reduce its workforce by several thousand this quarter as it prioritises growth in software and services.

OpenAI is set to release its Sora social video application for Android devices, following its recent debut on iPhone.

Caterpillar intends to more than double its gas turbine production capacity to meet surging demand for natural gas power plants.

Hims & Hers Health disclosed ongoing negotiations with Novo Nordisk to offer its forthcoming obesity medication through the telehealth platform.

According to Bloomberg news, Yum! Brands has commenced a strategic review of Pizza Hut, considering various options as the chain faces increasing competition in the pizza industry.

S&P 500 Best performing sector

Financials +0.55 %, with Apollo Global Management +5.29%, Global Payments +3.71%, and Travelers Companies +3.59%

S&P 500 Worst performing sector

Information Technology -2.27%, with CDW -8.51%, Palantir Technologies -7.94%, and Gartner -7.62%

Mega Caps

Alphabet -2.13%, Amazon -1.84%, Apple +0.45%, Meta Platforms -1.63%, Microsoft -0.52%, Nvidia -3.96% and Tesla -5.15%

Norges Bank opposes Musk’s controversial equity award. On Thursday, Tesla will conduct its annual shareholder meeting and announce the outcomes of votes on several key proposals, including Elon Musk’s compensation package. This package would grant Musk an additional 12% equity stake in Tesla if he succeeds in elevating the company’s valuation to $8.5 trillion within the coming decade.

Norges Bank Investment Management, which oversees Norway’s $1.9 trillion sovereign wealth fund and holds a 1.2% stake in Tesla — making it, according to FactSet, the sixth-largest institutional investor after firms such as Vanguard and BlackRock — has voted against Musk’s proposed $1 trillion pay package. It is the first major institutional investor to publicly disclose its voting decision, citing concerns regarding the magnitude of the award, potential dilution, and insufficient mitigation of key person risk.

Shareholders will also decide on the re-election of board members and consider a proposal urging Tesla’s board to invest in Musk’s artificial intelligence venture, xAI.

In addition to Norges Bank Investment Management, several smaller public pension funds, including the American Federation of Teachers and various New York City retirement systems, along with prominent proxy advisory firms Institutional Shareholder Services and Glass Lewis, have expressed opposition to the compensation plan.

However, some shareholders, such as Morgan Stanley’s Counterpoint Global fund and Florida’s public pension fund, have expressed support for the proposal.

Information Technology

Best performer: Motorola Solutions +0.70%

Worst performer: CDW -8.51%

Materials and Mining

Best performer: DuPont de Nemours +8.85%

Worst performer: Albemarle -8.37%

European Stock Indices

CAC 40 -0.52%

DAX -0.76%

FTSE 100 +0.14%

Corporate Earnings Reports

Posted on Tuesday, 4th November

Advanced Micro Devices quarterly revenue +35.6% to $9.246 bn vs $8.971 bn estimate

EPS at $1.20 vs $1.16 estimate

Lisa Su, Chair and CEO, said, “We delivered an outstanding quarter, with record revenue and profitability reflecting broad based demand for our high-performance EPYC and Ryzen processors and Instinct AI accelerators. Our record third quarter performance and strong fourth quarter guidance marks a clear step up in our growth trajectory as our expanding computer franchise and rapidly scaling data center AI business drive significant revenue and earnings growth.” — see report.

Live Nation Entertainment quarterly revenue +11.1% to $8.499 bn vs $8.576 bn estimate

EPS at $0.73 vs $1.32 estimate

Michael Rapino, President and CEO, said, “Strong fan demand drove another record quarter, as we continue to attract more fans to more shows globally. With these tailwinds, 2026 is off to a strong start with a double-digit increase in our large venue show pipeline and increased sell-through levels for these shows. At the same time, we’re continuing to invest in new venues to grow the market, create jobs, and give artists even more ways to reach fans, positioning Live Nation on a clear path for double-digit operating income and AOI growth this year and compounding at this growth level over the next several years.” — see report.

Uber Technologies quarterly revenue +20.4% to $13.467 bn vs $13.284 bn estimate

EPS at $3.11 vs $0.69 estimate

Dara Khosrowshahi, CEO, said, “Uber’s growth kicked into high gear in Q3, marking one of the largest trip-volume increases in the company’s history. We’re building on that momentum by investing in lifelong customer relationships, leaning into our local commerce strategy, and harnessing the transformative potential of AI and autonomy.” — see report.

Spotify quarterly revenue +7.1% to €4.272 bn vs €4.233 bn estimate

EPS at €3.28 vs €1.96 estimate

Daniel Ek, Founder and CEO, said, “The business is healthy. We’re shipping faster than ever. And we have the tools we need – pricing, product innovation, operational leverage, and eventually the ads turnaround – to deliver both revenue growth and profit expansion. It all comes back to user fundamentals and that’s where we are: 700 million users who keep coming back, engagement at all-time highs. We’re building Spotify for the long-term.” — see report.

Commodities

Gold spot -1.73% to $3,931.78 an ounce

Silver spot -1.95% to $47.14 an ounce

West Texas Intermediate -1.25% to $60.26 a barrel

Brent crude -0.80% to $64.34 a barrel

Gold prices fell on Tuesday after the dollar's advance to a three-month high. Spot gold fell -1.73%, settling at $3,931.78. The dollar index's rise rendered gold more expensive for holders of other currencies.

Typically, non-yielding gold performs well in low-interest-rate environments and during periods of economic uncertainty. Although gold has risen +49.58% year-to-date, it has retreated -10.26% from its record peak reached on 20th October.

Oil prices declined on Tuesday, pressured by weaker manufacturing data and a strengthening dollar, both of which contributed to concerns about demand. Additionally, OPEC+'s decision on Sunday to allow a modest production increase in December, then a pause in output increases in the first quarter of next year, reflects the group's caution regarding a potential oversupply in the market.

Brent crude futures settled at $64.34 per barrel, a decrease of 52 cents or -0.80%. US WTI crude fell by 76 cents, or -1.25%, to close at $60.26 per barrel.

The dollar's ascent to a four-month high against the euro further weighed on oil prices, as a stronger US currency makes dollar-denominated commodities more costly for holders of other currencies.

Note: As of 5 pm EST 4 November 2025

Currencies

EUR -0.33% to $1.1481

GBP -0.93% to $1.3018

Bitcoin -6.06% to $100,393.08

Ethereum -10.75% to $3,213.46

On Tuesday, the dollar index surpassed 100 for the first time since early August, reaching 100.20, an increase of +0.32%.

The US dollar advanced to a four-month high against the euro, driven by divisions within the FOMC that cast doubt on the likelihood of an additional rate cut this year. This uncertainty, combined with a broader risk-off sentiment, prompted investors to seek dollar safety. The euro fell for the fifth consecutive session, slipping -0.33% to $1.1481, its lowest level since 1st August.

The British pound declined after the Chancellor of the Exchequer, Rachel Reeves, signalled the necessity of making ‘hard choices’ in her forthcoming budget statement on 26th November. She cited the challenging economic environment, elevated debt levels, sluggish productivity, and persistent inflation. Sterling fell -0.93% to $1.3018.

Against the Japanese yen the dollar was down -0.36% to ¥153.66, though the Japanese currency remained close to an eight-and-a-half-month low.

Despite the dollar’s recent gains, some investors remain unconvinced that this strength signals a sustainable reversal in the currency’s longer-term trajectory. Upward revisions to US growth forecasts have been matched by similar adjustments in Europe, narrowing the gap in relative growth expectations compared to the start of 2025. In this context, a benign global growth outlook does not support a prolonged dollar rally.

Fixed Income

US 10-year Treasury -2.4 basis points to 4.089%

German 10-year bund -1.3 basis points to 2.656%

UK 10-year gilt -1.3 basis point to 4.429%

US Treasuries advanced on Tuesday as investors sought the relative safety of government bonds amid growing concerns that elevated valuations in equities and corporate bonds may precipitate a market correction. The absence of scheduled economic data, attributed to the ongoing US government shutdown — which on Tuesday reached its 35th day, equaling the record for the longest in history set during President Donald Trump's first term — left the bond market largely without clear direction aside from safe-haven flows.

By the afternoon, the yield on the 10-year Treasury note was -2.4 bps to 4.089%. The yield on the 30-year bond fell -2.7 bps to 4.668%. The two-year yield, which is particularly sensitive to interest rate expectations, dropped -3.1 bps to 3.586%.

The government shutdown has also delayed the release of the closely watched monthly employment report from the Bureau of Labor Statistics, originally scheduled for Friday. Consequently, investors will turn to the ADP employment report, an independent labour market survey set for release today, for insights into labour market conditions.

Additionally, the Treasury Department is expected to announce details regarding its quarterly refunding operations. These are expected to be closely monitored by bond market participants for indications of how the government intends to manage its financing needs.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 69.0% probability of a 25 bps rate cut at December FOMC meeting, lower than last week’s 90.5%. Traders are currently expecting 17.3 bps of cuts by year-end, lower than the 22.8 bps anticipated last week.

Demand for Germany’s 10-year government bond rose Tuesday as subdued US economic data weighed on global risk sentiment.

The yield on Germany’s 10-year bond fell -1.3 bps to 2.656%, after having reached its highest level since 10th October on Monday. At the longer end of the curve, the 30-year yield decreased -1.4 bps to 3.239%, while at the shorter end, the 2-year yield — particularly sensitive to shifts in ECB policy expectations —declined -1.2 bps to 1.990%.

France’s 10-year bond yield also edged lower, dropping -1.0 bps to 3.438%. As a result, the yield spread between French and German 10-year bonds was 78.2 bps. Italy’s 10-year yield was slightly lower, by -0.4 bps, to 3.376%, leaving the spread over Bunds at 72.0 bps.

Last week’s ECB policy meeting was largely uneventful, with rates unchanged. President Christine Lagarde reaffirmed that monetary policy remains in a ‘good place.’ Current market pricing reflects roughly a 50% probability of another rate cut by the Q3 of next year, a figure that has seen little movement since the latest ECB meeting.

Note: As of 5 pm EST 4 November 2025

Global Macro Updates

Chancellor Reeves outlines budget principles ahead of November release. UK Chancellor of the Exchequer Reeves outlined the guiding principles for the upcoming Budget, scheduled for 26th November. Although the Chancellor did not rule out the possibility of tax increases, she refrained from specifying any particular measures. Reeves noted that the global landscape has shifted since the previous budget, attributing weak productivity to the prior government’s austerity measures, underinvestment, Brexit, and the pandemic. She also highlighted the impact of tariffs, elevated global borrowing costs, and defence-related pressures. The Chancellor stated that the budget will prioritise long-term economic stability, debt reduction, and lowering the cost of living.

She emphasised that current economic forecasts reflect past conditions rather than future prospects. Many analysts believe that income tax is the most likely candidate for an increase, following reports that the Treasury is considering a 2% rise, along with the possibility of extending the freeze on tax thresholds. Additional measures under consideration include revisions to capital gains and inheritance tax, property reforms, pension tax relief changes, and potential sector-specific levies.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

هذه المقالة متاحة لأغراض ملعوماتية فقط، ولا ينبغي اعتبارها عرضًا أو التماسًا لعرض شراء أو بيع أي استثمارات أو خدمات ذات صلة يمكن الإشارة إليها هنا. ينطوي التداول في الأدوات المالية على مخاطر كبيرة من الخسارة وقد لا يكون مناسبًا لجميع المستثمرين. الأداء السابق ليس مؤشرًا موثوقًا به للأداء المستقبلي.