Will AI gobble ‘til it wobbles?

Markets in November

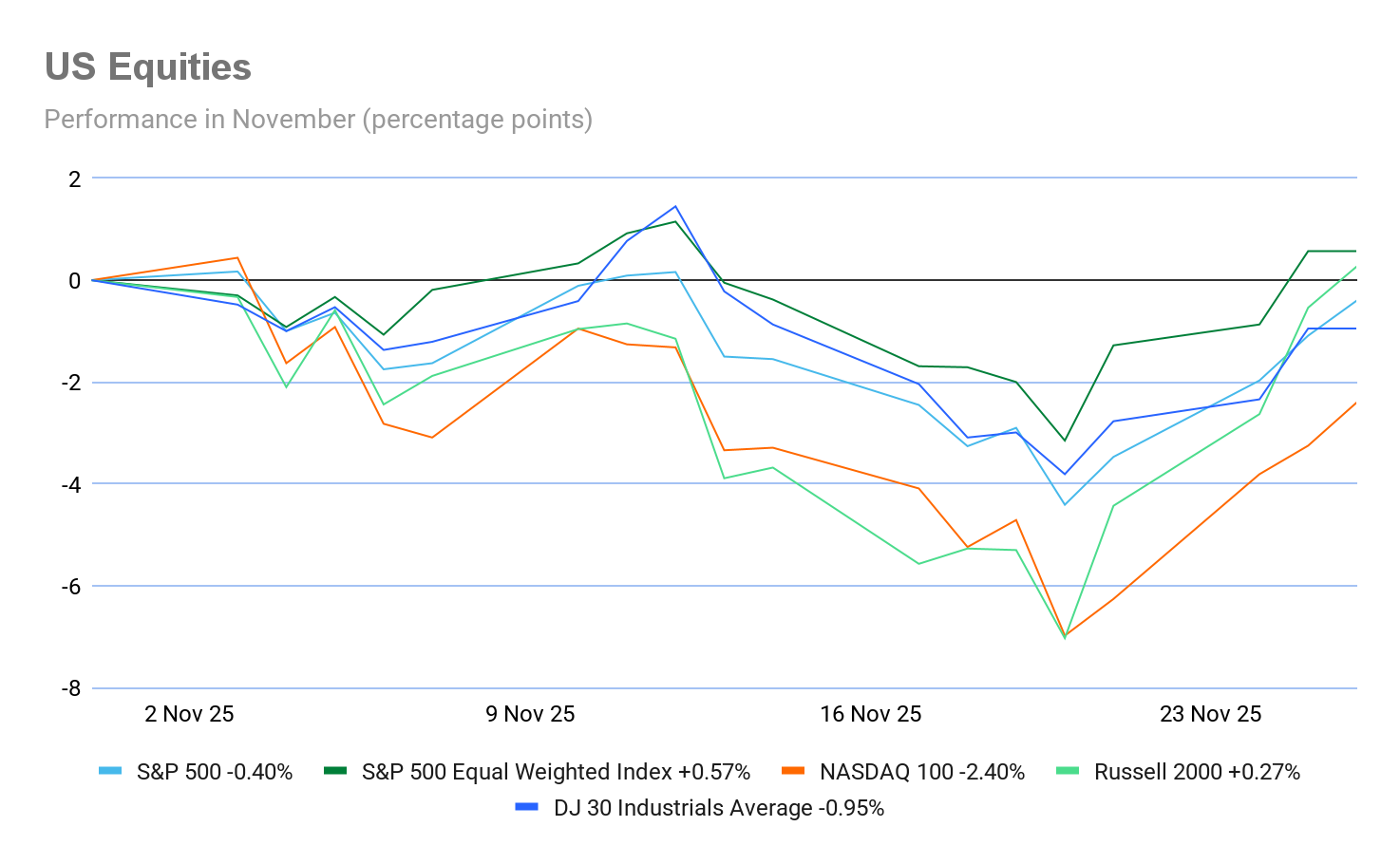

Major US indices have shown a mostly negative month-to-date (MTD) performance: S&P 500 -0.40%, Nasdaq 100 -2.40%, Dow Jones -0.95%, and Russell 2000 +0.27%.

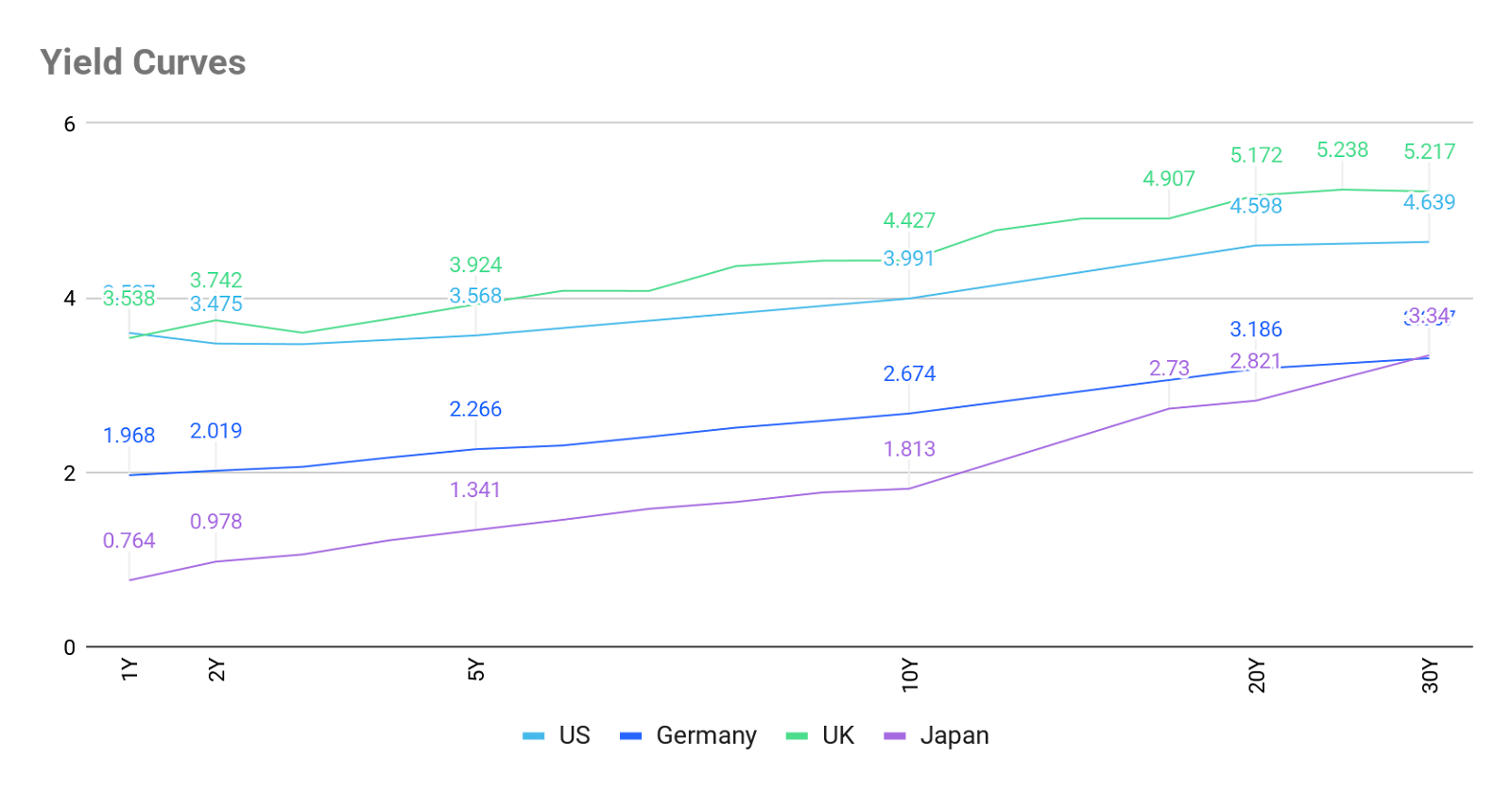

US bond markets have rallied across the curve in November as expectations of a Fed rate cut in December continue to grow following New York Fed President Williams arguing in favour of a cut. Risk premiums, however, appear to be widening, so investors may begin shifting focus to duration. In Europe, bond yields have risen on expectations that the ECB has completed its rate cutting cycle and on signs of economic recovery.

The economic picture

USA. US economic data was limited in November as the government agencies tried to catch up on the release of economic data following the end of the 43 day government shutdown.

On the consumer side, confidence weakened to its lowest level since April. The Consumer Confidence Index declined 6.8 points in November to 88.7 from 95.5 in October. The Present Situation Index—based on consumers’ assessment of current business and labour market conditions — fell by 4.3 points to 126.9. The Expectations Index—based on consumers’ short-term outlook for income, business, and labour market conditions — fell by 8.6 points to 63.2. The Expectations Index has tracked below 80 for ten consecutive months, the threshold under which the gauge signals recession ahead. Consumers’ average 12-month inflation expectations remained elevated in November, and the median rate increased to 4.8%. The share of consumers expecting interest rates to rise edged lower in the month to about 50%, while the proportion expecting lower rates ticked down after rising over the past several months.

Business activity was broadly up in November. The November Flash S&P PMI composite reading was slightly up from October’s 54.6 to 54.8, a 4-month high. The Flash Services PMI also edged up, reaching 55.0 from October’s 54.8 and another 4-month high. However, the Flash PMI Manufacturing hit a 4-month low in November, coming in at 51.9, down from October’s 52.5. The pace of job creation meanwhile remained only modest, due to cost concerns. Input costs rose at one of the fastest rates seen over the past three years, driving a reacceleration of selling price inflation. Higher costs and prices were again attributed to tariffs. These cost of living concerns may be reflected in retail sales. According to Commerce Department data, US retail sales rose only modestly in September, increasing 0.2% after a 0.6% gain in August. Excluding cars and gas, sales rose just 0.1%. The November Beige Book seemed to support these results, with overall consumer spending declining further, while higher-end retail spending remained resilient. Some retailers noted a negative impact on consumer purchases from the government shutdown.

The Bureau of Labor Statistics cancelled its October consumer price index report, saying it was unable to retroactively obtain some data that wasn’t collected during the US government shutdown. It is not expected to publish CPI data until 18 December. It has revealed that, prior to the government shutdown, PPI was up in September, rising 0.3% from a month earlier after easing in August. However, excluding food and energy, PPI rose by less than forecast from August and climbed 2.6% from a year ago — the smallest gain since July 2024.

On the labour front, the November Beige Book suggests employment declined slightly over the current period with around half of Districts noting weaker labour demand. This rise seems slightly incongruous with the September non-farm payroll report and the latest initial jobless claims. That report indicated nonfarm payrolls climbed by 119,000, the biggest increase since April. The three-month average payroll gain advanced to 62,000 from just 18,000 for the three months through August. However, that payroll report did suggest a slight weakening of the employment rate, with unemployment rising to 4.4%, but this was attributed to an expansion in the labour force, with the participation rate climbing to 62.4%. However, initial jobless claims decreased by 6,000 to 216,000 in the week ending 22 November, the lowest level since mid-April. This suggests that layoffs remain low despite consumers expectations.

EU. Eurozone headline inflation in October came in at 2.1% y/o/y, down from September’s 2.2%. Core inflation remained at 2.4% in October. Services prices had the highest annual rate in October (3.4%, compared with 3.2% in September), followed by food, alcohol & tobacco (2.5%, compared with 3.0% in September), non-energy industrial goods (0.6%, compared with 0.8% in September) and energy (-0.9%, compared with -0.4% in September).

The European Commission's consumer confidence index remained broadly stable, ±0.0 percentage points, in the euro area. Consumer confidence, at -14.2 points, remained below its long-term average.

Eurozone business activity growth continued in November, suggesting solid growth momentum in the services sector. The HCOB Flash Composite PMI was slightly lower in November at 52.4, down from October’s 52.5. The HCOB Flash Services PMI edged up to 53.1, from October’s 53.0, an 18-month high. Nevertheless, weaknesses in the eurozone economy persist, with manufacturing once again moved into contractionary territory, with the HCOB Flash Manufacturing PMI slipping to 49.7 from October’s 50.0, a 5-month low.

The German Ifo Business Climate Survey for November showed that sentiment among companies in Germany has deteriorated. The ifo Business Climate Index fell to 88.1 points in November, down from 88.4 points in October. An expectations index dropped to 90.6 in November from 91.6 the previous month.

In France Prime Minister Sebastien Lecornu is still struggling to pass the 2026 budget by the end of the year after the deeply divided lower house of parliament rejected the “revenues” part of the 2026 Finance Bill on 22 November.

UK. The UK’s economy is continuing to slow with the Office for National Statistics figures suggesting that GDP grew by only 0.1% in the three months to September 2025, following growth of 0.2% in the three months to August 2025 (revised down from an initially reported 0.3%). This suggested slowdown was supported by the November S&P Flash Business activity surveys. Economic growth has stalled, job losses have accelerated, and business confidence has deteriorated. The Flash PMI Composite Output Index fell to a two-month low of 50.5 from October’s 52.2. The Flash Services PMI hit a 7-month low, falling to 50.5 from October’s 52.3. The surprise was in the Flash UK Manufacturing PMI, which hit a 14-month high, rising into contractionary territory and hitting 50.2, up from October’s 49.7. As noted by Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, “The PMI is broadly consistent with no change in GDP in November and a meagre 0.1% quarterly pace of growth so far in the fourth quarter. The drop in confidence about the year ahead reflects growing concerns that business conditions will remain tough in the coming months, largely linked to speculation that further demand-dampening measures will be introduced in the Budget.” There was at least some good news for inflation as prices charged for goods fell at the sharpest rate since 2016. However, as he noted, it’s bad news for business profits, hiring and investment.

Government borrowing was £7.2 billion more than forecast in the first six months of the fiscal year, with the budget deficit climbing to £99.8 billion. The budget deficit climbed to £99.8 billion, overshooting the £92.6 billion forecast by the Office for Budget Responsibility in March. As noted by Bloomberg news, the government has paid £59.5 billion servicing the debt this year so far, an increase of £14.4 billion on the same period in 2024. According to Bloomberg Economics, higher borrowing costs, U-turns over welfare cuts and a predicted productivity downgrade by the Office for Budget Responsibility (OBR) means that the Chancellor of the Exchequer, Rachel Reeves, will need to find as much as £35 billion just to restore the £9.9 billion buffer she left against her binding fiscal rule when she reveals the budget on 26 November.

Retail sales in the UK fell 1.1% month-on-month in October, with lower supermarket and clothing sales. It followed an increase of 0.7% in September 2025 and of 0.5% in August. This was the first monthly fall since May. The GfK consumer confidence index fell two points to -19 in November. All measures declined from October’s results. The index measuring changes in personal finances over the last year fell by two points to -7. The measure of the country’s general economic situation over the last 12 months declined by one point to -43. This was a four-point drop from November 2024. Expectations for the general economic situation over the next 12 months have fallen two points to -32. This is six points worse than November 2024.

On Wednesday the government revealed its autumn budget. It will see taxes on dividends, property and savings income increased by 2 percentage points, which is expected to raise £2.1 billion. However, as noted by the Office for Budget Responsibility (OBR), new spending policies, including the removal of a so-called two-child limit on welfare, will increase public borrowing by £7 billion next year, and by £11 billion in 2029-30.The OBR lowered its growth forecast by 0.3 percentage points, citing lower underlying productivity growth. It now expects gross domestic product to grow 1.5% on average over the next five years. Debt will remain an issue; the government has borrowed more than forecast this year. Government borrowing in October was above expectations at £17.4 billion, with the deficit in the first seven months of the 2025-26 fiscal year climbing to £116.8 billion.

Inflation in the UK remains well above the BoE target. Headline CPI came in at 3.6% y/o/y in October, but still down from 3.8% in September. Core inflation came in at 3.4% in the 12 months to October 2025, down from 3.5% in the 12 months to September. The CPI goods annual rate fell from 2.9% to 2.6%, while the CPI services annual rate fell from 4.7% to 4.5%.

Global market indices

USA:

S&P 500 -0.40% MTD and +15.83% YTD

Nasdaq 100 -2.40% MTD and +20.11% YTD

Dow Jones Industrial Average -0.95% MTD and +10.74% YTD

NYSE Composite +1.18% MTD and +13.70% YTD

Source: FactSet

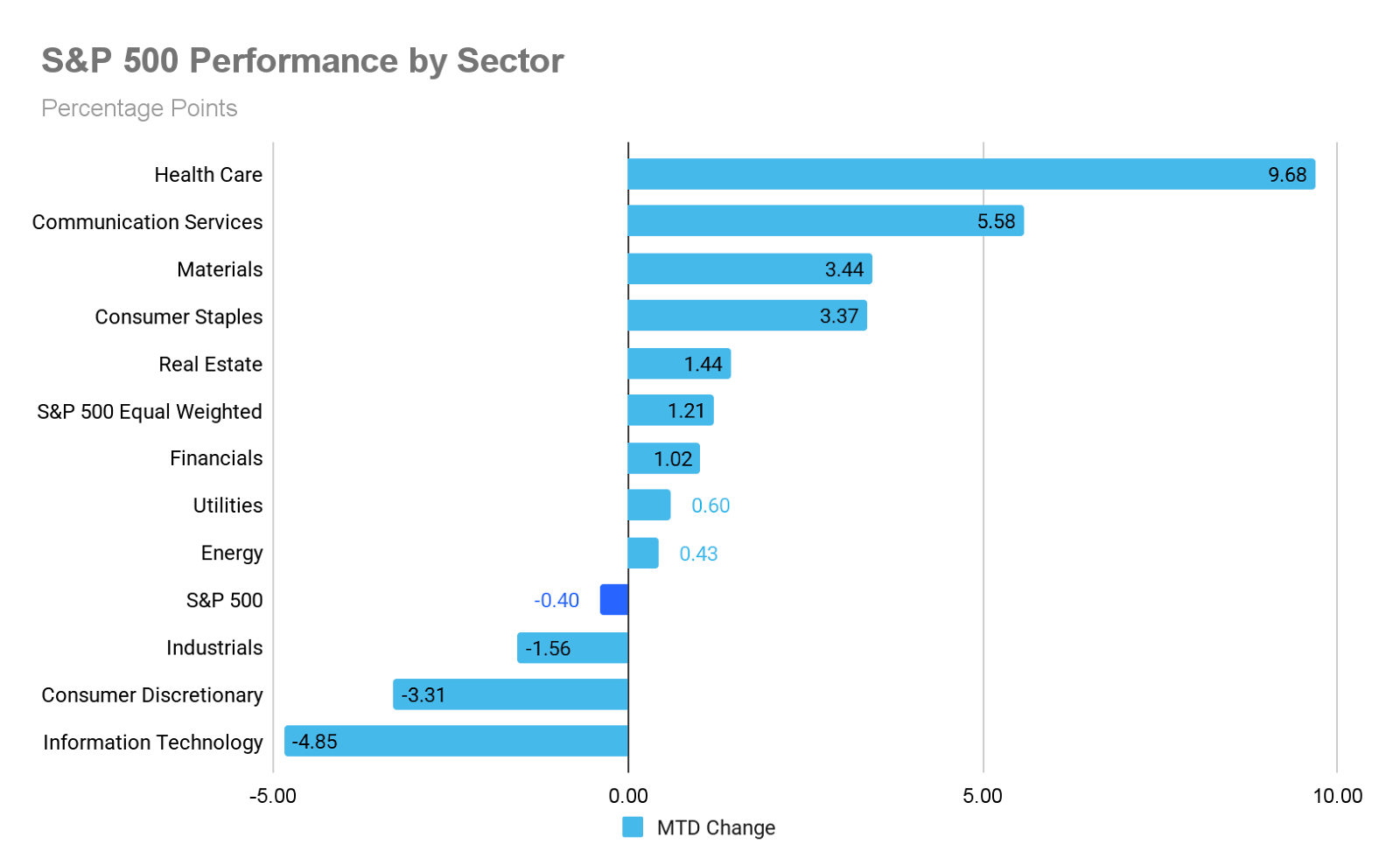

The Equally Weighted version of the S&P 500 is +1.21% MTD for October, 1.61 percentage points higher than the benchmark.

The S&P 500 Health Care sector is the top performer thus far in November at +9.68% MTD, while Information Technology underperformed at -4.85% MTD.

Investors appeared optimistic before today’s US Thanksgiving holiday. On Wednesday, major US equity indices recorded their fourth consecutive session of gains, driven by heightened expectations for interest rate reductions and renewed enthusiasm for the AI trade. After rising +0.82% on Wednesday, the Nasdaq Composite is poised to deliver its strongest Thanksgiving week performance since 2008.

Market advances on Wednesday were broad-based, with all but two sectors within the S&P 500 posting gains, resulting in a +0.69% increase in the broader benchmark. Similarly, the Dow Jones Industrial Average rose by approximately 315 points, or +0.67%. Both indices are on track for their best Thanksgiving week results since 2012.

This week features a shortened trading schedule, with markets closed today in observance of the holiday and both the Nasdaq and New York Stock Exchange concluding trading at 1 pm ET on Friday.

In corporate news, New York City Comptroller Brad Lander has called on three of the city’s pension funds to divest from BlackRock, citing the firm’s ‘inadequate’ climate strategies—marking the latest instance of investment managers facing consequences for insufficient action on global warming.

Shares of Dell Technologies advanced +5.83% following the company’s upward revision of its annual forecasts for the artificial intelligence server market.

Deere & Co’s initial outlook for the upcoming year fell below market expectations, with ongoing uncertainty regarding the timing of a recovery in the US agricultural sector and concerns over tariffs expected to weigh on earnings.

Robinhood Markets and Susquehanna International Group are set to assume control of a regulated exchange previously affiliated with the now-defunct cryptocurrency firm FTX.

Europe:

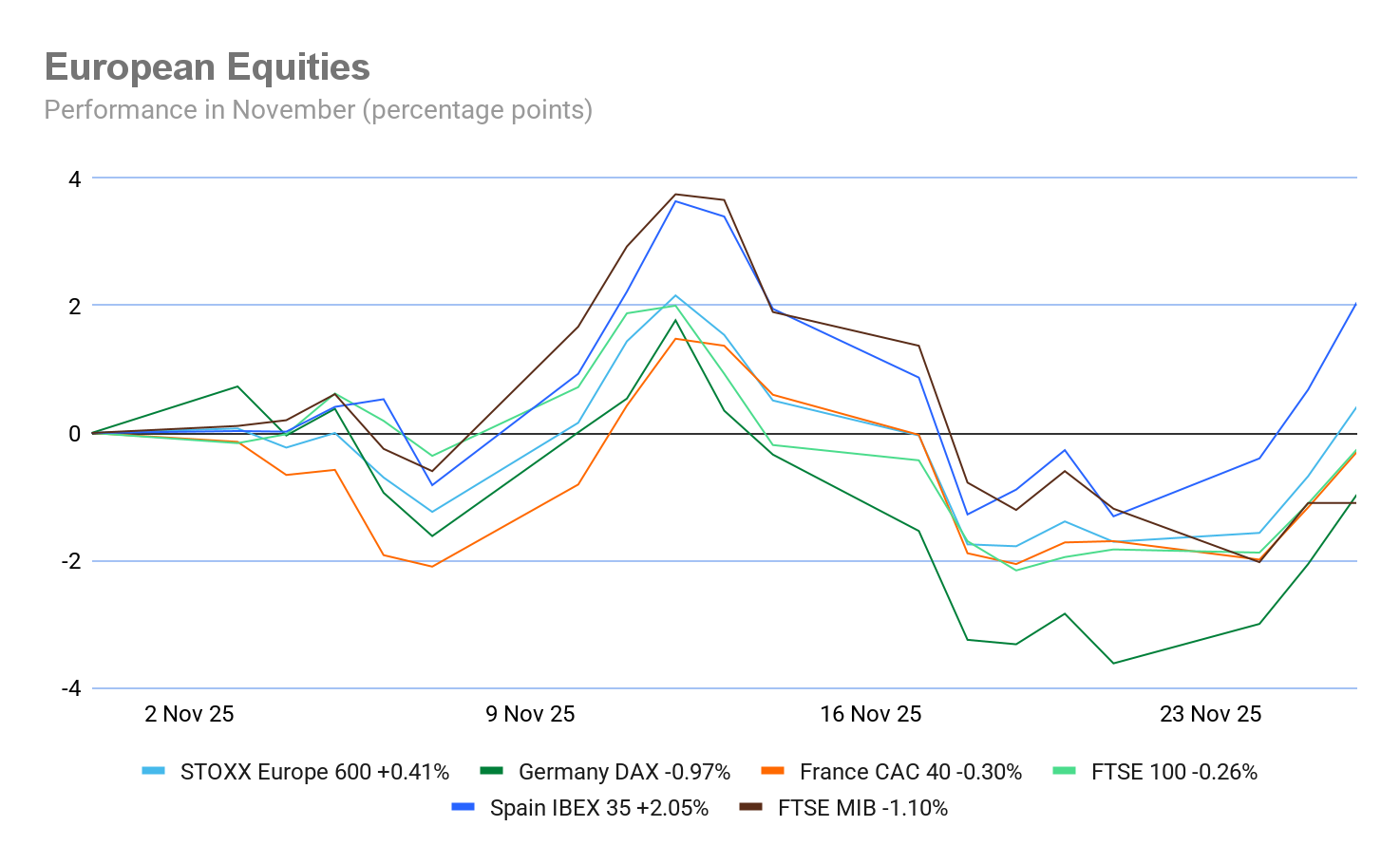

Stoxx 600 +0.41% MTD and +13.12% YTD

DAX -0.97% MTD and +19.17% YTD

CAC 40 -0.30% MTD and +9.70% YTD

FTSE 100 -0.26% MTD and +18.58% YTD

IBEX 35 +2.05% MTD and +41.10% YTD

FTSE MIB -1.10% MTD and +24.90% YTD

Source: FactSet

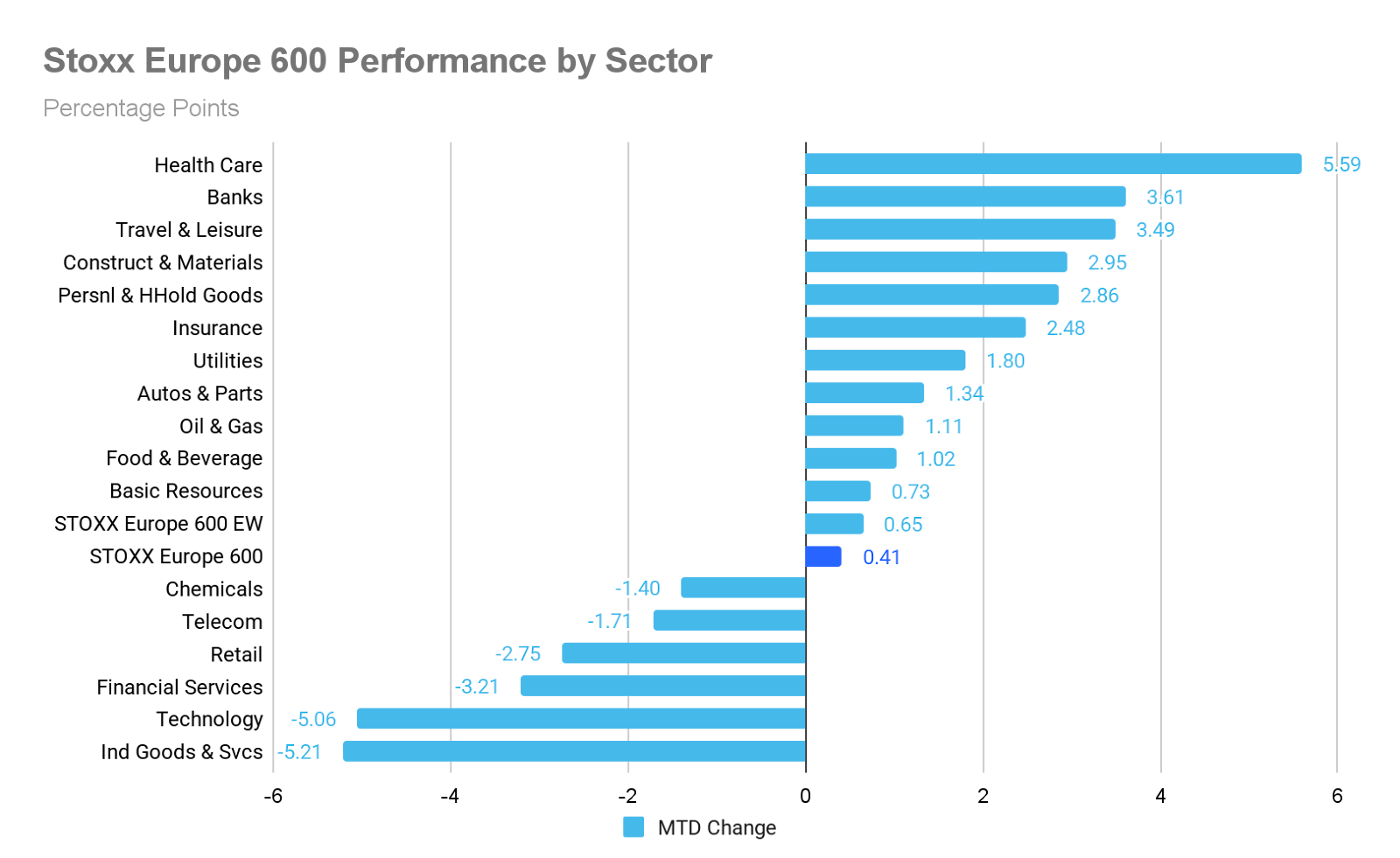

In Europe, the Equally Weighted version of the Stoxx 600 is -0.65% MTD, 1.06 percentage points lower than the benchmark.

The Stoxx 600 Health Care is the leading sector, +5.59% MTD, while Industrial Goods exhibited the weakest performance at -5.21% MTD.

On Wednesday, within the STOXX Europe 600 sectors, Banks outperformed, supported by major UK lenders, as the UK budget refrained from imposing any specific measures targeting the sector. Basic Resources also advanced, fuelled by gains in base metals. Technology traded higher despite minimal news flow.

In contrast, Media and Food & Beverage underperformed. WPP is at risk of being removed from the FTSE 100 index. Carlsberg Group was upgraded to overweight by JPMorgan, according to a sector note. Autos & Parts also traded lower. Real Estate under pressure following Britain’s announcement of a new annual tax on homes valued at more than £2 million.

Valneva reported strong efficiency and safety data for its Lyme disease vaccine candidate. Elekta’s Q2 EBIT was 7.5% above consensus. Pets at Home Group announced a series of actions to enhance retail business performance and launched a turnaround plan. Adecco Group reiterated its commitment to maintaining a 3% - 6% margin corridor and keeping leverage at or below 1.5x by the end of 2027, although investors continue to express concerns about AI risks. Colruyt Group was downgraded to underweight at Barclays.

Global:

MSCI World Index -0.60% MTD and +18.88% YTD

Hang Seng +0.08% MTD and +29.25% YTD

Mega cap stocks have had a mixed performance so far in November. Alphabet +13.78%, and Apple +2.66%, while Meta Platforms -2.27%, Amazon -6.17%, Microsoft -6.24%, Tesla -6.57%, and Nvidia -10.98%.

Materials and Mining stocks have been mostly positive so far in November. The Materials sector is +3.44% MTD. Albemarle +29.20%, Sibanye Stillwater +13.53%, Newmont Mining +11.79%, Nucor Corporation +6.05%, Celanese Corporation +5.31%, and Freeport-McMoRan +1.08%, while Yara International -0.62%, and Mosaic -11.62%.

Commodities

Gold prices remained close to their highest levels in over a week on Wednesday.

Spot gold advanced by +0.78%, reaching $4,162.04 per ounce after earlier touching its peak since 14th November during the session.

Year-to-date, gold has appreciated by +58.63%. It is +2.02% so far this week and is +4.00% MTD.

Oil prices rebounded on Wednesday, recovering from one-month lows recorded during the previous session, as investors weighed the potential for oversupply and monitored ongoing discussions regarding a Russia-Ukraine peace agreement ahead of the US Thanksgiving holiday.

Brent crude futures closed 42 cents, or +0.67%, higher at $63.03 per barrel. US WTI crude futures rose by 47 cents, or +0.81%, to $58.55 per barrel.

US WTI is -3.83% MTD and is -18.36% YTD. Brent crude is -3.14% MTD and -15.54% YTD.

According to three OPEC+ sources cited by Reuters, the group is expected to maintain current output levels at its meeting this Sunday. Market participants continued to seek further details on the progress of negotiations between Russia and Ukraine on Wednesday.

On Tuesday, Ukrainian President Volodymyr Zelenskiy informed European leaders of his readiness to pursue a US-supported framework aimed at resolving the conflict with Russia, which contributed to Brent crude and WTI prices reaching their lowest levels in a month.

Additionally, US President Donald Trump announced that he had instructed his representatives to hold separate meetings with Russian President Vladimir Putin and Ukrainian officials. A Ukrainian official indicated that President Zelenskiy may visit the United States in the coming days to finalise an agreement.

EIA report. According to the EIA’s report released Wednesday, US crude oil inventories increased as imports reached their highest level in eleven weeks. Fuel inventories also expanded, supported by a rise in refining activity. For the week ending 21st November, crude stocks climbed by 2.8 million barrels to a total of 426.9 million barrels.

At the Cushing, Oklahoma delivery hub, crude inventories declined by 68,000 barrels during the same period.

US crude exports were 3.6 million barrels per day (bpd), down 560,000 bpd from the previous week. Net US crude imports rose 1.05 million bpd to 2.84 million bpd, marking the highest level since early September.

Refinery crude throughput increased by 211,000 bpd, and refinery utilisation rates advanced by 2.3 percentage points, reaching 92.3%.

Total product supplied, which serves as a proxy for demand, rose by 83,000 bpd to 20.24 million bpd. Gasoline inventories grew by 2.5 million barrels to 209.9 million barrels, while distillate stockpiles—including diesel and heating oil—increased by 1.1 million barrels to 112.2 million barrels, according to EIA data.

Currencies

On Wednesday, the yen depreciated against the dollar after initial gains — spurred by speculation surrounding a potential BoJ rate hike next month — proved short-lived. Sterling strengthened, supported by a UK budget announcement that delivered a larger-than-anticipated fiscal buffer.

The dollar retreated as market participants continued to anticipate a reduction in interest rates by the Fed at its upcoming December meeting. The euro closed the session +0.22% higher at $1.1594, while the dollar index declined by -0.24% to 99.57.

The yen remains a focal point for investors, who are vigilant for signs of official Japanese intervention to counter the currency’s ongoing weakness. Sources cited by Reuters indicate that the BoJ is preparing the markets for a potential rate increase as early as next month, reviving hawkish rhetoric as concerns over pronounced yen depreciation resurface and political resistance to higher rates fades.

Following the Reuters report, the yen initially appreciated against the dollar but subsequently reversed course, falling -0.28% to ¥156.47 after reaching an intraday high of ¥155.66. While official intervention is possible during the Thanksgiving holiday period, heightened market apprehension regarding such measures may itself curb further dollar/yen advances, thereby reducing the likelihood of direct intervention.

The release of the UK's budget drew significant attention to the British pound. Sterling rose +0.56% against the dollar to $1.3240 and also gained versus the euro, which declined -0.30% to 87.64 pence. Chancellor of the Exchequer Rachel Reeves presented a budget that seemingly provided £21.7 bn by 2029-30 in fiscal headroom. The Office for Budget Responsibility reported that the government now possesses more than twice its previous fiscal buffer. However, with welfare spending rising and growth expected to slow during the course of this parliament, this figure will be closely monitored by investors evaluating Britain’s credit risks. As noted by Mohamed El-Erian in the Financial Times, “if this budget fails to ignite the growth and productivity engines, the UK risks extending a loop where each subsequent fiscal event becomes harder than the last, risking higher borrowing costs for both the public and private sectors, as well as inflation-causing currency depreciations.”

The US dollar index is -0.14% so far in November and is -8.20% YTD. The GBP is +0.68% against the dollar in November and is +5.82% YTD. The EUR is +0.56% MTD against the USD and +12.00% YTD.

Cryptocurrencies

Bitcoin -17.65% MTD and -3.65% YTD to $90,189.85

Ethereum -21.71% MTD and -9.56% YTD to $3,022.23

Bitcoin was +4.03% to $90,189.85 and Ethereum was +3.07% to $3,022.23 on Wednesday. They are -4.78% and -4.35%, respectively, over the past seven days.

Cryptocurrencies have not managed to fully recover since the 10th October liquidation of $19 bn in leveraged positions, resulting in Bitcoin falling about 24% since its early October high and the crypto market losing about $1 trillion in value. However, the latter part of November has seen buyers stepping back in as a broader risk-on mood has taken hold due to increasing expectations of a Fed cut at the December meeting. Cryptocurrencies are once again starting to move in tandem with equity markets.

Although forced liquidations and thin market liquidity continued to weigh on Bitcoin and Ethereum in November, liquidity appears to be improving with institutional flows supporting the late November rally. Cryptocurrency Spot ETFs are now logging stronger inflows. In the US, retirement funds are gradually integrating Bitcoin exposure. However, if the delayed US economic data reveals a worsening macro picture, then outflows from these ETF funds are likely to accelerate, creating opportunity for further falls. Nevertheless, the fundamentals of Bitcoin in particular have not changed.

As noted by The Motley Fool, Bitcoin still has a fixed supply, and the halving will still make future production of the supply harder. On the demand side, structural adoption is continuing with over 150 new crypto ETFs expected, making it easier for investors to get exposure to cryptocurrencies. And digital asset treasury (DAT) companies are still accumulating cryptocurrencies such as Bitcoin with the intention to hold it forever.

Note: As of 5:30 pm EDT 26 November 2025

Fixed Income

US 10-year yield -8.0 bps MTD and -57.7 bps YTD to 3.999%

German 10-year yield +4.0 bps MTD and +30.5 bps YTD to 2.674%

UK 10-year yield +1.9 bps MTD and -14.1 bps YTD to 4.427%

US Treasury yields showed mixed performance Wednesday as robust economic data prompted some selling activity. Treasuries had previously rallied for four consecutive sessions, buoyed by increasing expectations of a Fed interest rate cut in December. This momentum encouraged certain investors to realise gains during Wednesday’s session.

The US bond market displayed dynamics similar to those observed in the UK, where Finance Minister Rachel Reeves’ budget temporarily alleviated concerns regarding Britain’s fiscal outlook, leading investors to favour long-dated UK government bonds. Global bond markets can move in tandem, influenced by arbitrage, hedging strategies, and shared economic signals.

On the economic front, data from the Commerce Department’s Census Bureau indicated that new orders for core US-manufactured capital goods increased in September, with shipments posting significant gains. These results reinforced economists’ expectations for accelerated economic growth in Q3. Following these data releases, Treasury yields edged higher, contributing additional selling pressure to a market already undergoing consolidation.

The Fed’s Beige Book, also released Wednesday, suggested US economic activity had changed little in recent weeks. However, employment conditions weakened in roughly half of the Fed’s 12 districts, and a decrease in consumer spending likely heightened concerns about a softening labour market.

The 10-year Treasury yield stood at 3.999%, down -0.1 bps for the day, after dipping below the 4% threshold on Tuesday for the first time in nearly a month. The two-year yield rose +2.0 bps to 3.485%, while the 30-year yield declined -0.7 bps to 4.644%. The closely monitored yield curve, comparing two- and 10-year maturities, has steepened 1.7 bps in November to 51.4 bps from 49.7 bps at October’s end.

On the supply front, the Treasury Department auctioned $44 billion in seven-year notes on Wednesday, which attracted subdued demand. The notes were priced at a high yield of 3.781%, approximately half a basis point above market levels at the time of bidding, indicating that investors sought a modest premium to absorb the new issuance.

The yield on the US 10-year Treasury note is -8.0 bps MTD for October. The US 30-year yield is -1.1 bps. At the short end, the two-year Treasury yield is -9.7 bps MTD.

Current sentiment in the Fed funds futures market, according to CME's FedWatch Tool, suggests a 84.7% probability of a rate reduction to the Fed funds rate at the December FOMC meeting. Markets are pricing in an implied target rate 21.2 bps lower by year-end, compared to 7.5 bps the week prior.

Eurozone government bond yields remained stable Wednesday, following three consecutive days of declines. Investors largely disregarded volatility in the gilt market that arose after Britain revealed plans to increase taxes.

Germany’s 10-year yield edged down by -0.5 bps to 2.674%, as market participants turned their attention to the budget presented by British Finance Minister Rachel Reeves.

The Office for Budget Responsibility in the UK reported that the government’s fiscal headroom — the excess capacity for additional spending or tax reductions while adhering to budgetary constraints — was projected to reach nearly £22 billion over the next five years.

Gilt markets experienced considerable volatility during the budget announcement, with the 10-year yield dropping by -7.2 bps to 4.427%, marking its lowest level in almost two weeks. The UK's 30-year gilt yield, particularly sensitive to long-term fiscal developments, declined by -10.7 bps to 5.217%, representing its largest single-day decrease since April.

Across eurozone bond markets, investor sentiment has been shaped more by differences in rate expectations between the Fed and the ECB. Earlier in the week, eurozone bond yields drifted slightly lower, yet market pricing suggests that investors anticipate the ECB will maintain interest rates at current levels, at least through the end of the year.

Germany’s two-year Schatz — more responsive to expectations regarding ECB policy rates — was unchanged on Wednesday, holding steady at 2.019%. On the long end of the maturity spectrum, the 30-year Bund yield was +0.4 bps higher at 3.307%.

The German 10-year yield is +4.0 bps MTD for November. The spread between US 10-year Treasuries and German Bunds stands at 132.5 bps, reflecting a contraction of 12.0 bps over the month so far, from 144.5 bps at the end of October.

The 2-year Schatz is +4.7 bps to 2.019% so far in November. At the long end, the German 30-year yield is +9.5 bps to 3.212%.

France’s 10-year OAT yield is -1.9 bps to 3.403% MTD. The spread of French government bonds versus German Bunds has narrowed by 5.9 bps over the month to 72.9 bps, from 78.8 bps at the end of October.

Italy's 10-year government bond yield declined by -1.1 bps to 3.396%, leaving the spread over its German equivalent at 72.2 bps. During November, this spread has narrowed slightly by 0.7 bps. The Italian 10-year BTP yield has advanced by +3.3 bps so far in November.

In the UK, the 10 year gilt yield is +1.9 bps higher MTD after falling by -7.2 bps Wednesday at 2.674% following the release of the budget. The UK 30 year is +4.2 bps so far in November, reaching 5.217%.

Note: As of 5:00 pm EDT 26 November 2025

What to think about in December 2025

FOMC meeting: the data dilemma. The US government shutdown has created unprecedented uncertainty for monetary policy and equity markets by cancelling critical economic data just as the Fed prepares for its December policy meeting. The Bureau of Labor Statistics cancelled October inflation and employment reports due to the 43-day shutdown, while the Bureau of Economic Analysis postponed the Q3 GDP estimate until 23rd December — leaving the Fed with a significant information vacuum at a pivotal policy juncture.

The November employment and inflation figures have been delayed until 16th and 18th December, respectively, arriving after the 9th – 10th December FOMC meeting. This leaves FOMC members making interest rate decisions based on September data alone, requiring reliance on alternative indicators including ADP private payroll data, weekly jobless claims, and the Fed's Beige Book.

The delayed data has created sharp divisions within the FOMC regarding a December rate cut. Fed Chair Jerome Powell had previously indicated that another rate cut in December is uncertain. While Fed Governor Christopher Waller and New York Fed President John Williams signalled support for easing, citing soft labour market conditions and anchored inflation expectations, several other officials including Kansas City Fed President Jeffrey Schmid and Fed Governor Michael Barr have expressed caution. Chicago Fed President Austan Goolsbee acknowledged that the absence of inflation data — which lacks reliable private-sector alternatives — 'complicates matters significantly.’

The data disruption has injected volatility into equity valuations. Implied volatility spiked last week as markets priced and repriced rate cut expectations, with the S&P 500 and Nasdaq Composite experiencing sharp swings. However, dovish Fedspeak last week and positive AI momentum restored confidence. Equities recovered most mid-month losses as implied market pricing odds of rate-cut increased above 70% last week.

Supporting the December setup for equities is the end of quantitative tightening on 1st December. However, the policy path remains data-dependent on macro developments arriving after the December decision. Market momentum, anchored inflation expectations, and expectations of corporate earnings strength provide countervailing support, yet elevated volatility should persist until clarity emerges on the Fed's actual policy trajectory.

Fed’s latest Beige Book. Because policymakers lacked access to hard data during the shutdown, this edition carries extra weight. Fed officials claimed they remained informed through local stories, making this report the best insight into an economy missing concrete data. The Beige Book released on Wednesday indicated that economic activity remained largely unchanged, treading water, across the majority of its twelve districts. Of these, two districts experienced a modest decline, while one reported modest growth. Consumer spending was generally flat or decreasing in most regions, with only the higher-end retail sector demonstrating notable resilience.

Overall, the economic outlook was stable, although there were increasing references to downside risks and heightened uncertainty. Despite this cautious sentiment, some manufacturers expressed optimism. Labour market conditions showed signs of softening, as employment levels declined in approximately half of the districts. Reports pointed to weakened labour demand, hiring freezes, a focus on replacement-only hiring, and attrition rather than layoffs. Employers also noted persistent challenges in filling skilled positions, particularly those typically occupied by immigrants.

Wage growth was modest overall, but somewhat stronger in manufacturing, construction, and healthcare sectors due to tighter labour supply. Inflationary pressures moderated, though persistent growth in input costs was observed, especially in manufacturing and retail, driven in part by tariffs, and rising insurance and utility expenses. Commentary on price passthrough to consumers was mixed, with some businesses experiencing margin compression due to tariffs.

Credit quality deteriorated within several districts, as banks reported rising loan delinquencies and increasing consumer reliance on debt. Business credit demand remained subdued or slightly declined, with lending standards continuing to be restrictive.

Key events in December 2025

The potential policy and geopolitical risks for investors that could affect corporate earnings, stock market performance, currency valuations, sovereign and corporate bond markets and cryptocurrencies include:

1 December The US takes over the rotating presidency of the G20 from South Africa. Instead of a large meeting to handover the presidency for the next year, this will be a low-key event as the Trump administration is still offering refuge to white South Africans.

5-6 December 23rd India-Russia Annual Summit. Indian Prime Minister Narendra Modi plans to host Russian President Vladimir Putin in India. Trade cooperation will dominate the agenda. India has come under increasing pressure from the US to reduce crude imports from Russia.

9-10 December Federal Reserve Monetary Policy Statement and Summary of Economic Projections. With some of the data that the Fed relies upon still not likely to be available by the time of the meeting, there is greater uncertainty around the next Fed move. Market expectations are growing that the Fed will cut rates again by 25 bps at this meeting based on the softening labour market data from the Beige Book and September jobs report.

18 December Bank of England, Monetary Policy Summary and minutes of the Monetary Policy Committee meeting. With inflation still above target at 3.6% and uncertainty around potential economic growth impacts from the 26 November budget, the BoE is expected to keep rates at 4.00% during this meeting.

18-19 December Bank of Japan Monetary Policy. The BoJ is coming under increasing pressure to raise rates, with board member Asahi Nogushi stating that it can resume interest rate hikes as risks from US tariffs subside but must do so at a "measured, step-by-step" pace and board member Junko Koeda said last week the BoJ must keep raising real interest rates as prices have been “relatively strong.” Focus is shifting back to inflationary risks of a weak yen, especially due to the expected fiscal stimulus from Prime Minister Sanae Takaichi’s government. A meeting between the Prime minister and BoJ Governor Kazuo Ueda appeared to remove immediate political objections to rate hikes from the new administration.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here. Trading financial instruments involves significant risk of loss and may not be suitable for all investors. Past performance is not a reliable indicator of future performance.