Q4 financials: 2026’s first red flag?

What to look out for today

Companies reporting on Wednesday, 14th January: Wells Fargo, Citigroup, Bank of America, and Infosys

Key data to move markets today

EU: A speech by ECB Vice President Luis de Guindos

UK: Speeches by BoE’s MPC External Member Alan Tayor and Deputy Governor Dave Ramsden

USA: PPI, Core PPI, Retail Sales, Existing Home Sales, Fed’s Beige Book, and speeches by Philadelphia Fed President Anna Paulson, Fed Governor Stephen Miran, Atlanta Fed President Raphael Bostic, Minneapolis Fed President Neel Kashkari, and New York Fed President John Williams

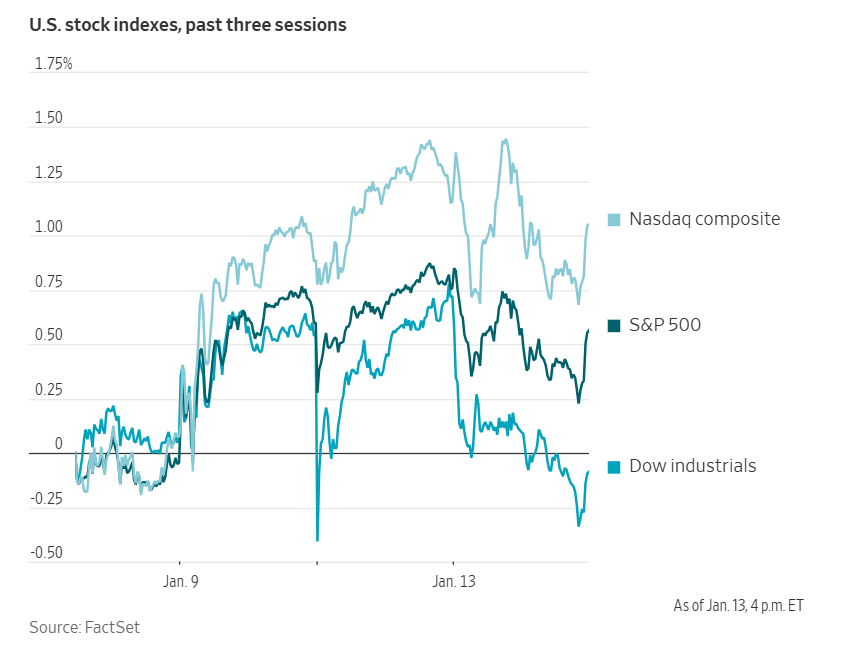

US Stock Indices

Dow Jones Industrial Average -0.80%

Nasdaq 100 -0.18%

S&P 500 -0.19%, with 4 of the 11 sectors of the S&P 500 down

Financials weighed on major indices Tuesday following JPMorgan Chase’s Q4 earnings report, which failed to meet investor expectations.

The largest US bank reported a 7.0% decline in quarterly profit, despite total revenue increasing by 7.0% to $8.24 billion, due to a surprising reduction in investment-banking fees. Shares of JPMorgan closed -4.19% lower, while the broader financial sector retreated -1.84% on Tuesday.

Investment banking fees decreased to $2.3 billion compared to $2.5 billion in the same period last year, driven by lower revenues from deal-making, debt transactions, and notably, equity underwriting. CFO Jeremy Barnum indicated that while some transactions had been postponed, bankers remain optimistic for the year ahead.

On Monday, JPMorgan’s shares experienced a decline of just over one percent following statements by the US President over the weekend outlining plans to implement a one-year cap on credit card interest rates at 10%. Industry organisations have warned that such a cap could prompt banks, including JPMorgan, to significantly reduce their existing credit card portfolios. Barnum declined to specify how the bank would respond should the cap be enacted, stating that ‘you have to assume that everything’s on the table.’

The largest US banks are among the first major companies to report earnings each quarter. Market participants closely monitor these results as key indicators of the broader economic environment.

The Dow Jones Industrial Average underperformed other stock indexes, declining -0.80% or 398 points, partly due to losses in JPMorgan and Visa shares. The S&P 500 slipped -0.19%, closing below Monday’s record, while the Nasdaq Composite Index edged -0.10% lower.

In corporate news, Meta Platforms and EssilorLuxottica are reportedly considering doubling production capacity for AI-powered smart glasses by the end of the year to meet rising demand and outpace competitors. Discussions include increasing annual capacity to at least 20 million units by the end of 2026, with the potential to exceed 30 million units if warranted by demand. This initiative underscores Meta’s ambition to expand its AI strategy into hardware, reducing its dependence on smartphones manufactured by rivals.

Apollo Global Management is seeking to initiate trading on a private debt transaction supporting Elon Musk’s artificial intelligence venture, xAI. The funds facilitated xAI’s access to Nvidia’s graphics processing units and related data centre infrastructure. Apollo has informed other lenders of its willingness to acquire additional portions of the $3.5 billion chip financing at par.

TSMC is planning a significant expansion in Arizona as part of ongoing US – Taiwan trade negotiations, according to The Wall Street Journal. The company intends to invest a minimum of $100 billion over the next four years in US semiconductor manufacturing facilities.

The US Department of Defense is poised to invest $1 billion in L3Harris Technologies’ missile division through a convertible preferred security, strengthening the direct relationship between the government and a leading defence contractor.

Netflix is reportedly revising its acquisition terms for Warner Bros. Discovery and has considered submitting an all-cash offer for the company’s studios and streaming operations, according to individuals familiar with the matter.

US Bancorp, the US’ largest regional bank, has announced plans to acquire brokerage firm BTIG for up to $1 billion as part of its broader strategy to expand further into investment banking and trading.

S&P 500 Best performing sector

Energy +1.53%, with Texas Pacific Land +3.79%, APA +3.21%, and Devon Energy +3.14%

S&P 500 Worst performing sector

Financials -1.84%, with Progressive -5.28%, Allstate -5.28%, and Visa -4.46%

Mega Caps

Alphabet +1.11%, Amazon -1.57%, Apple +0.31%, Meta Platforms -1.69%, Microsoft -1.36%, Nvidia +0.47%, and Tesla -0.39%

Information Technology

Best performer: Intel +7.33%

Worst performer: Salesforce -7.07%

Materials and Mining

Best performer: Albemarle +4.46%

Worst performer: Smurfit Westrock -0.61%

Corporate Earnings Reports

Posted on Tuesday, 13th January

JPMorgan quarterly revenue +7.1% to $45.798 bn vs $46.167 bn estimate

EPS at $4.63 vs $4.85 estimate

Jamie Dimon, Chairman and CEO, said, “Each line of business performed well. In the CIB, revenue rose 10%. Markets continued to benefit from demand for financing and robust client activity, pushing revenue up 17%. Additionally, Payments revenue reached a record $5.1 billion due to ongoing deposit and fee growth. In CCB, revenue rose 6%, and the franchise continued to acquire new customers at a robust pace. This year, we opened 1.7 million net new checking accounts and 10.4 million new credit card accounts, and we also grew wealth management households to over 3 million. Looking ahead, we are excited to become the new issuer of the Apple Card. Finally, in AWM, revenue rose 13% in the quarter to a record $6.5 billion. More impressively, client asset net inflows totaled $553 billion for the year, helping drive client assets to over $7 trillion.” — see report.

Delta Airlines quarterly revenue +1.2% to $14.606 bn vs $14.682 bn estimate

EPS at $1.55 vs $1.53 estimate

Ed Bastian, CEO, said, “The Delta team delivered a strong close to our Centennial year, demonstrating the differentiation and durability we’ve built. Our industry-leading performance delivered for our customers and our employees, while creating value for our owners, consistent with our long-term financial framework. We generated $5 billion of pre-tax profit with a double-digit operating margin and record free cash flow of $4.6 billion, all while navigating a challenging environment. These results would not be possible without the exceptional efforts of our people and I look forward to celebrating our team next month with $1.3 billion of well-earned profit sharing." — see report.

European Stock Indices

CAC 40 -0.14%

DAX +0.06%

FTSE 100 -0.03%

Commodities

Gold spot -0.25% to $4,586.45 an ounce

Silver spot +2.09% to $86.49 an ounce

West Texas Intermediate +2.07% to $61.08 a barrel

Brent crude +1.79% to $65.38 a barrel

Gold reached a new record high on Tuesday, as ongoing geopolitical and economic uncertainties continued to fuel demand for safe-haven assets. Silver also hit fresh highs during the session.

Despite surging to a historic high of $4,634.33 per ounce earlier in the day, spot gold subsequently eased -0.25% to end the trading day at $4,586.45 per ounce.

In response to heightened market volatility, CME Group announced Monday that it will adjust margin requirements for precious metals.

Meanwhile, spot silver advanced +2.09% to $86.49 per ounce. It reached an all-time high of $89.10 earlier in the session.

Oil prices advanced by over one percent on Tuesday, as concerns regarding potential disruptions to Iranian crude exports outweighed the possibility of increased supply from Venezuela. The premium for Brent crude oil over the Middle East benchmark Dubai increased on Tuesday to its highest level since July.

Brent crude futures rose $1.15, or +1.79%, settling at $65.38 per barrel. US WTI crude closed at $61.08 per barrel, increasing $1.24, or approximately +2.07%.

Iran, a leading producer within OPEC, is currently experiencing its most significant anti-government demonstrations in years. According to Iranian officials, government actions against protestors have resulted in approximately 2,000 fatalities and the detention of thousands. This crackdown prompted a warning from the US President regarding possible military intervention.

On Monday, President Trump announced that any nation engaging in trade with Iran will be subject to a 25% tariff on business conducted with the US. China remains Iran’s largest crude oil buyer.

Further indicating potential supply constraints, four oil tankers managed by Greek companies were attacked by unidentified drones on Tuesday. Reuters, citing eight sources, reported that the tankers, situated in the Black Sea and en route to load oil at the Caspian Pipeline Consortium terminal near the Russian coast, were targeted.

Note: As of 4 pm EST 13 January 2026

Currencies

EUR -0.21% to $1.1642

GBP -0.28% to $1.3424

Bitcoin +3.49% to $94,147.88

Ethereum +3.88% to $3,208.54

The US dollar strengthened broadly following a brief decline, as December CPI data largely met economists' expectations.

This was despite concerns around the Fed's independence following the US Department of Justice threatening to indict Fed Chair Jerome Powell in connection with a building renovation project.

On Tuesday, global central bank officials released a coordinated statement expressing support for Chair Powell.

The dollar index rose +0.29% to 99.17, while the euro declined -0.21% to $1.1642.

The British pound was -0.28%, settling at $1.3424, after gaining +0.47% on Monday. It was at 86.62 pence per euro.

Current market pricing indicates expectations for one, and possibly two, BoE rate cuts in the first half of this year. However, a rapid decrease in inflation could prompt further monetary easing.

The Japanese yen fell to its lowest level against the US dollar since July 2024, driven by concerns regarding more accommodative fiscal and monetary policies in Japan. The Japanese yen weakened -0.63% against the US dollar, reaching ¥159.16 per dollar. The currency's rapid depreciation has heightened market vigilance for potential intervention aimed at stabilising the yen.

Japanese Prime Minister Sanae Takaichi may call an early general election, according to the leader of her party's coalition partner. Media reports suggest that she is considering scheduling the vote for February. Such a move would enable Prime Minister Takaichi to leverage the strong public approval ratings she has maintained since assuming office in October.

Japan's Finance Minister Satsuki Katayama stated that she and US Treasury Secretary Scott Bessent share concerns over the yen's recent ‘one-sided depreciation.’ In response, Japanese authorities have intensified warnings of intervention to address the currency's decline.

Fixed Income

US 10-year Treasury +0.1 basis points to 4.183%

German 10-year bund +0.6 basis points to 2.850%

UK 10-year gilt +2.8 basis points to 4.402%

On Tuesday, US Treasury yields experienced modest increases across the curve following the Labor Department's report that the CPI rose +0.3% in the previous month, aligning with market expectations. Over the twelve months ending in December, the CPI advanced +2.7%, mirroring November’s rate and meeting consensus estimates.

The yield on the 10-year US Treasury note edged higher by +0.1 bps, settling at 4.183%. The yield on the 30-year Treasury bond was +1.3 bps to 4.843%. On the short end, the two-year US Treasury yield was +0.4 bps to 3.545%.

The yield spread between two-year and 10-year Treasury notes was 63.8 bps.

St Louis Fed President Alberto Musalem reiterated the Fed’s commitment to returning inflation to its 2% target. He described Tuesday’s data as encouraging with respect to progress toward that goal, but emphasised there is no immediate justification for additional rate cuts.

The Treasury’s auction of $22 billion in 30-year bonds on Tuesday was met with robust demand, with a bid-to-cover ratio of 2.42x, surpassing the historical average. Monday’s auctions of $58 billion in three-year notes and $39 billion in 10-year notes were also well received by market participants.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 53.1 bps of cuts in 2026, lower than the 59.6 bps priced in the previous week. Fed funds futures traders are now pricing in a 2.8% probability of a 25 bps rate cut at January’s FOMC meeting, from 12.2% a week ago.

Eurozone bond yields advanced on Tuesday, recovering from declines observed in the previous session.

Germany’s 10-year government bond yield increased +0.6 bps to 2.850%, following a decrease of -2.3 bps on Monday.

The yield on German two-year securities eased -0.5 bps to 2.099%. At the longer end of the curve, the 30-year German yield rose +1.9 bps to reach 3.454%.

Similarly, 10-year yields in France and Italy climbed, rising +1.9 bps and +2.4 bps to 3.524% and 3.493%, respectively.

European nations, including Belgium and Spain, conducted significant bond issuances on Tuesday.

Note: As of 5 pm EST 13 January 2026

Global Macro Updates

December core CPI slightly cooler than anticipated. Core Consumer Price Index (CPI) increased by 0.2% m/o/m, falling short of the anticipated 0.3% rise. Headline CPI advanced 0.3% m/o/m, aligning with expectations. There are no prior m/o/m comparisons, as the Bureau of Labor Statistics was unable to collect October data. On an annualised basis, core inflation registered at 2.6%, marginally below both the consensus estimate and the previous reading of 2.7%. Annualised headline inflation stood at 2.7%, slightly exceeding the consensus of 2.6% and matching the prior figure.

Core goods prices were unchanged on a m/o/m basis, while core services experienced a 0.3% increase. The shelter index, rising by 0.4% m/o/m, was the primary contributor to December's inflation, as anticipated by most analysts following an assumed flat reading in October. Other areas of inflation included airline fares, which rose by 5.2%, food prices up 0.7%, and apparel prices higher by 0.6%, potentially reflecting the impact of tariffs.

There was a 1.1% decline in prices for used cars and trucks, while new vehicle prices remained stable. Additional areas that posted decreases included appliances, down 4.3%, and furniture and bedding, which declined by 0.4%.

Initial analyst commentary emphasised that the report presented no substantial surprises and was expected to display volatility due to distortions from the government shutdown. The prevailing consensus among analysts suggests that the Fed's attention remains focused on labour market conditions. The probability of a rate cut in January was largely unaffected by Tuesday's data.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here. Trading financial instruments involves significant risk of loss and may not be suitable for all investors. Past performance is not a reliable indicator of future performance.