Is the Fed worried about the “squeezed” middle?

Corporate Earnings Calendar

Thursday: Alliant Energy, Deere & Company, Centerpoint Energy, EPAM Systems, Live Nation Entertainment, Newmont, Southern, Walmart

Friday: PPL

Monday: Diamondback Energy, Dominion Energy, Domino’s Pizza, ONEOK

Tuesday: American Tower, Axon Enterprise, EOG Resources, First Solar, GoDaddy, Home Depot, HP, Keurig Dr Pepper, Mosaic, NRG Energy

Wednesday: APA, Lowe’s Companies, Nvidia, Paramount Skydance, Pinnacle West Capital, Raymond James Financial, Salesforce, TKO Group

Global market indices

US Stock Indices Price Performance

Nasdaq 100 -2.56% MTD and -1.39% YTD

Dow Jones Industrial Average +1.31% MTD and +3.06% YTD

NYSE +2.94% MTD and +6.29% YTD

S&P 500 -0.83% MTD and +0.52% YTD

The S&P 500 is -0.87% over the past seven days, with 7 of the 11 sectors up MTD. The Equally Weighted version of the S&P 500 is -0.03% over this past week and +6.10% YTD.

The S&P 500 Materials is the leading sector so far this month,+6.87% MTD and +16.11% YTD, while Communication Services is the weakest sector at -8.00% MTD and -2.76% YTD.

Over the past seven days, Utilities outperformed within the S&P 500 at +2.09%, followed by Real Estate and Consumer Discretionary at +1.35% and +0.90%, respectively. Conversely, Communication Services underperformed at -2.49%, followed by Information Technology and Energy at -1.73% and -1.04%, respectively.

The equal-weight version of the S&P 500 was +0.57% on Wednesday, outperforming its cap-weighted counterpart by 0.01 percentage points.

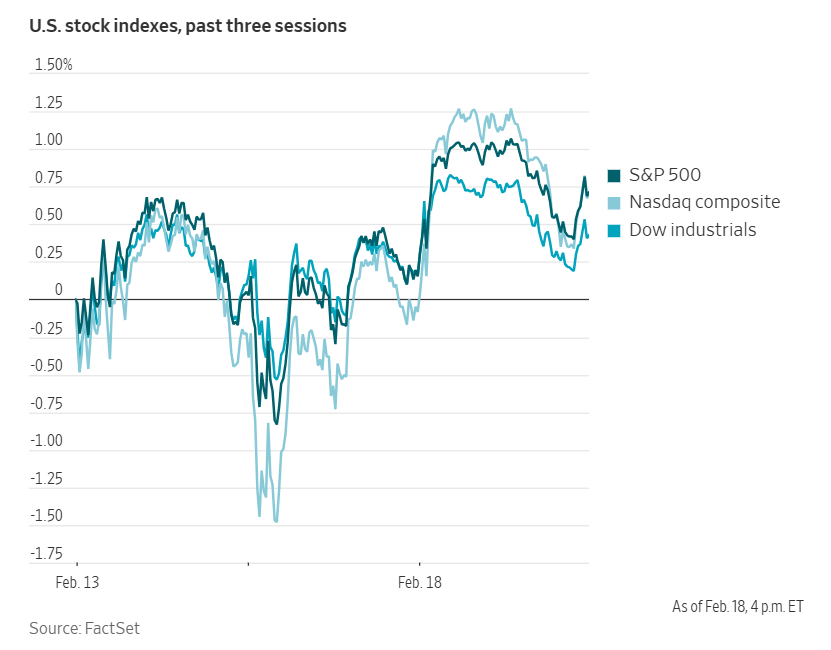

On Wednesday the S&P 500 was at 6,881.31, up +0.56%, while the Dow Jones Industrial Average advanced +0.26%, or 129.47 points. The Nasdaq Composite Index rose +0.78% to 22,753.63.

Over the past seven days, the S&P 500 is -0.87%, the Dow Jones -1.17%, and the Nasdaq Composite -1.36%.

In corporate news, Berkshire Hathaway reduced its holding in Amazon by over 75% during Q4, while simultaneously initiating a position in The New York Times, marking Warren Buffett’s final investment decision as Berkshire’s CEO.

Caesars Entertainment reported a Q4 loss. However, revenue exceeded expectations, and CEO Tom Reeg projected a stable outlook for the year ahead.

Kenvue delivered Q4 earnings exceeding forecasts and announced plans to reduce its workforce by 3.5% in preparation for a forthcoming takeover by Kimberly-Clark.

Steel Dynamics, in partnership with the Australian conglomerate SGH, submitted an enhanced bid for BlueScope Steel. The consortium stated that they would not increase their offer further unless a competing bid emerges.

The US Food and Drug Administration has agreed to review a Moderna flu vaccine employing mRNA technology, reversing an earlier decision that unsettled financial markets and led to public disagreements between the company and its regulator.

Kraft Heinz announced the imminent replacement of its North American president as the new CEO implements a strategy to stimulate growth in the underperforming food business, foregoing the previously planned split.

The board of directors at Madison Square Garden Sports approved a proposal to evaluate the spin off of the NBA’s New York Knicks and the NHL’s New York Rangers, a move intended to make it easier to attract investors to the teams.

Mega caps: The Magnificent Seven had a predominantly negative performance over the past week. Over the last seven days, Amazon +0.35%, while Nvidia -1.09%, Microsoft -1.18%, Alphabet -1.83%, Meta Platforms -3.81%, Tesla -3.96%, and Apple -4.05%.

Energy stocks had a mostly negative performance this week, with the Energy sector itself -1.04%. WTI and Brent prices are +0.28% and +0.80%, respectively, over the past week. Over the last seven days, APA +1.24%, Chevron +0.81%, and Baker Hughes +0.24%, while Occidental Petroleum -0.28%, Shell -0.43%, ConocoPhillips -0.62%, Halliburton -0.74%, BP -1.99%, Phillips 66 -2.54%, ExxonMobil -3.14%, Marathon Petroleum -4.35%, and Energy Fuels -4.39%.

Materials and Mining stocks had a predominantly negative performance this week, with the Materials sector -0.80%. Over the past seven days, Newmont Corporation +0.07%, while Yara International -0.66%, CF Industries -1.15%, Nucor -2.26%, Albemarle -2.40%, Freeport-McMoRan -4.45%, Mosaic -5.46%, Sibanye Stillwater -7.28%, and Celanese Corporation -9.41%.

European Stock Indices Price Performance

Stoxx 600 +2.90% MTD and +6.16% YTD

DAX +3.01% MTD and +3.22% YTD

CAC 40 +3.72% MTD and +3.43% YTD

IBEX 35 +1.77% MTD and +5.14% YTD

FTSE MIB +1.83% MTD and +3.15% YTD

FTSE 100 +4.53% MTD and +7.60% YTD

This week, the pan-European Stoxx Europe 600 index is +1.14%. It was +1.19% Wednesday, closing at 628.69.

So far this month in the STOXX Europe 600, Telecom is the leading sector +11.41% MTD and +16.09% YTD, while Technology is the weakest at -2.28% MTD and +2.89% YTD.

Over the past seven days, Telecom outperformed within the STOXX Europe 600, at +2.86%, followed by Financial Services and Technology at +2.76% and +2.53%, respectively. Conversely, Chemicals underperformed at -1.85%, followed by Food & Beverages and Utilities at -1.83% and -0.28%, respectively.

Germany's DAX index was +1.12% Wednesday, closing at 25,278.21. It was +1.70% over the past seven days. France's CAC 40 index was +1.39% Wednesday, closing at 8,429.03. It was +1.39% over the past week.

The UK's FTSE 100 index was +2.04% over the past seven days to 10,686.18. It was +1.23% on Wednesday.

In Wednesday's trading session, Basic Resources outperformed, with Glencore exceeding full-year 2025 EBITDA expectations and announcing an unexpected $2 billion shareholder return. The company secured long-awaited land access at Kamoto Copper Company, paving the way for 300,000 tonnes of copper production and extending mine life, reinforcing its copper-focussed growth outlook.

Defence and Aerospace also advanced within Industrial Goods & Services. BAE Systems reported slightly better-than-expected full-year results, with strong margins in the Air and Platform & Services segment and higher FCF due to advance payments. The broader defence sector was supported by reports that Germany is preparing to acquire a blocking minority stake of at least 25.1% in KNDS, the Franco-German manufacturer of the Leopard tank.

Banks traded higher, with Mediobanca gaining +6.8% following Banca Monte dei Paschi di Siena’s decision to acquire full control and delist the merchant bank at a 2.31x exchange ratio, boosting BMPS’s CET1 ratio above 16.5%.

Conversely, Chemicals underperformed. IMCD posted weak Q4 earnings, with double-digit declines in organic gross profit and EBITA, and margin compression across all regions. Bayer unveiled a $7.25 billion Roundup settlement proposal, with analysts highlighting the pending US Supreme Court decision as a key uncertainty for long-term liability resolution.

Health Care modestly underperformed. Genmab’s 2026 revenue guidance of $4.1 – 4.4 billion and profit of $0.9 – 1.4 billion fell short of expectations, with analysts noting limited pipeline developments outside core oncology franchises. However, Straumann’s Q4 organic growth exceeded expectations, driven by strong performance in Europe and improvement in North America.

Other Global Stock Indices Price Performance

MSCI World Index +0.31% MTD and +2.51% YTD

Hang Seng -2.49% MTD and +4.20% YTD

Over the past seven days, the MSCI World Index and Hang Seng Index are -0.60% and -2.06%, respectively.

Currencies

EUR -0.56% MTD and +0.32% YTD to $1.1782

GBP -1.42% MTD and +0.15% YTD to $1.3493

The euro declined on Wednesday following reports that ECB President Christine Lagarde intended to resign early. The dollar extended its gains, buoyed by positive economic data and the release of the FOMC January meeting minutes.

The dollar index climbed +0.66% to 97.74. This marked the greenback's third consecutive rise and its largest daily percentage increase since 30th January. The euro was down -0.57% to $1.1786. The euro has declined -0.76% over the last seven days.

Over the week, the dollar index is up +0.86%. The dollar index is +0.61% MTD and +0.54% YTD.

Sterling fell -0.55% to $1.3493 after official data showed UK annual consumer price inflation eased to 3.0% in January, matching economists' expectations and down from 3.4% in December, raising expectations of a 25 bps rate cut by the BoE this spring. The pound declined -0.97% over the last seven days.

Against the Japanese yen, the dollar gained +1.00% to ¥154.82 per dollar. The yen has appreciated +1.03% over the past seven days, and is +0.04% MTD and -1.17% YTD.

Note: As of 5:00 pm EST 18 February 2026

Cryptocurrencies

Bitcoin -21.25% MTD and -24.37% YTD to $66,324.15

Ethereum -28.21% MTD and -34.81% YTD to $1,941.71

Bitcoin is -2.14% over the last seven days and Ethereum is -1.41%. On Wednesday, Bitcoin was -1.96% to $66,324.15 and Ethereum was -2.88% to $1,941.71.

Bitcoin and Ethereum continued to drop this week on growing expectations that the Fed may not cut in March due to inflation appearing to drift lower while the job market shows some signs of steadying following last week’s stronger than expected payroll numbers. Spot Bitcoin and Ethereum ETFs experienced their fourth week of outflows, which have now totalled around $3.8 billion due to institutional deleveraging. However, as noted by The Block, the world’s largest asset manager, BlackRock, is looking to launch a yield-generating Ethereum fund in the US, according to an amended S-1 registration statement on Tuesday. According to the filing, a BlackRock affiliate purchased 4,000 seed shares at $25 each, providing $100,000 in initial capital for the trust. The iShares Staked Ethereum Trust ETF, expected to trade under the ticker ETHB, plans to “stake as much of the Trust’s ether as practicable,” equating to 70%–95% under normal market circumstances.

Note: As of 5:00 pm EST 18 February 2026

Fixed Income

US 10-year yield bps -15.7 bps MTD and -9.1 bps YTD to 4.081%

German 10-year yield -10.3 bps MTD and -11.6 bps YTD to 2.744%

UK 10-year yield -15.5 bps MTD and -10.3 bps YTD to 4.375%

US Treasury yields advanced on Wednesday, supported by economic data that reinforced expectations that the Fed will keep rates on hold for the foreseeable future. Additionally, the Treasury Department's $16 billion auction of 20-year bonds was met with subdued demand.

Data on Wednesday indicated that new orders for core US-manufactured capital goods exceeded expectations in December, while shipments of these goods also rose sharply. This points to strength in business spending on equipment and economic growth in Q4.

Further evidence of economic momentum was provided by separate data, which revealed that factory output increased in January at the fastest pace in 11 months.

The yield on the two-year Treasury note, sensitive to expectations for the Fed funds rate policy, rose +1.9 bps to 3.470%. It had reached a four-month low of 3.385% on Tuesday.

The 10-year US Treasury note yield increased +1.7 bps to 4.081%. On Tuesday, it had briefly fallen to 4.018%, the lowest level since 28th November.

Over the past week, the yield curve spread between two-year and 10-year notes narrowed by 3.7 bps to stand at 61.1 bps.

Yields continued to climb following a lacklustre 20-year bond auction. The Treasury's 20-year bonds were sold at a high yield of 4.664%, approximately 2 bps above market levels prior to the auction. The bid-to-cover ratio was 2.36x, the weakest observed since at least April 2023, with primary dealers absorbing a larger share than usual, highlighting subdued investor appetite.

Later today, the Treasury is scheduled to auction $9 billion in 30-year Treasury Inflation-Protected Securities (TIPS).

Over the past seven days, the yield on the 10-year Treasury note is -9.6 bps. The yield on the 30-year Treasury bond is -10.1 bps. On the shorter end, the two-year Treasury yield is -5.9 bps.

According to CME Group's FedWatch Tool, traders are pricing in 56.8 bps of cuts in 2026, higher than the 52.6 bps priced in last week. Fed funds futures traders are now pricing in a 5.9% probability of a 25 bps rate cut at March’s FOMC meeting, down from 6.4% last week.

Across the Atlantic, in the UK, on Wednesday the 10-year gilt was -0.8 bps to 4.375% on rising expectations of a rate cut by the BoE this spring following weaker employment and lower inflation data earlier this week. Over the past seven days, it was -10.6 bps.

On Wednesday, market participants assessed the potential implications of a possible early departure by ECB President Christine Lagarde on the outlook for monetary policy. Investors appear to have maintained their prevailing view that the ECB is likely to keep policy unchanged throughout this year. Interest rate expectations among traders remained largely unchanged midweek, with the consensus still broadly anticipating that the ECB will hold rates steady rather than initiate a cut before year-end.

German government bond yields reflected this sentiment, with the two-year yield, highly responsive to interest rate expectations, rising +1.3 bps to 2.051%. The 10-year yield edged up +0.4 bps to 2.744%, and the 30-year yield increased +0.2 bps to 3.407%.

Italian and French bonds outperformed Bunds. Italy’s BTP 10-year yield declined -0.8 bps on Wednesday to 3.349%. French OAT 10-year yield mirrored its Italian peer, declining -0.9 bps to 3.318%.

Over the past seven days, the German 10-year yield is -5.4 bps. Germany's two-year bond yield is -2.3 bps, while Germany's 30-year yield is -5.1 bps.

The yield spread between German Bunds and 10-year UK gilts reached 163.1 bps on Wednesday, a contraction of 5.2 bps over the past seven days.

The spread between US 10-year Treasuries and German Bunds is now 133.7 bps, 4.2 bps lower from last week’s 137.9 bps.

The spread between Italian BTP 10-year yields and German Bund 10-year yields stood at 60.5 bps, 0.3 bps lower than last week’s spread of 60.8 bps. The Italian 10-year yield was -5.7 bps over the last week.

Over the course of the week, France’s 10-year yield has declined -6.8 bps. The spread between the French OAT 10-year yield and German Bund 10-year yield stood at 57.4 bps, 1.4 bps lower than last week’s 58.8 bps.

Lagarde to leave the ECB prior to term completion. According to FT sources, Christine Lagarde may step down from the ECB before her term officially ends in 2027, potentially giving France and Germany significant influence over her successor ahead of the April 2027 French presidential election.

Although no formal timeline has been set, Lagarde's initial appointment took approximately four months, suggesting a possible departure later this year. This would be in line with the early exit signalled by Bank of France Governor François Villeroy de Galhau, enabling President Macron to nominate a successor. A potential win for the populist National Rally in 2027 could allegedly intensify scrutiny of EU institutions and raise questions about their independence.

The succession process occurs amidst broader leadership changes, including Croatia's Vujcic being nominated as vice president, increasing the likelihood that the next ECB president will come from a northern euro area country.

An FT poll of 70 economists, published on 5th January, identified Spain's former central bank chief Pablo Hernandez de Cos and former Dutch governor Klaas Knot as frontrunners, with Bundesbank President Joachim Nagel also mentioned, though Germany’s considerable representation in senior EU positions may hinder his prospects. An early transition could heighten uncertainty around the ECB's post-tightening policy and alter the balance of power within the Governing Council.

Commodities

Gold spot +2.29% MTD and +15.34% YTD to $4,975.90 per ounce

Silver spot -8.73% MTD and +8.37% YTD to $77.23 per ounce

West Texas Intermediate crude -1.00% MTD and +13.36% YTD to $65.08 a barrel

Brent crude -0.68% MTD and +15.28% YTD to $70.22 a barrel

Gold advanced by more than two percent on Wednesday, as investors weighed escalating geopolitical risks.

Spot gold increased +2.01%, reaching $4,974.90 per ounce, following a decline of -2.28% on Tuesday, its lowest point in a week. Over the last seven days, gold prices have declined -2.10%.

Similarly, spot silver rose +5.06% to $77.23 per ounce, recovering from a -4.01% drop on Tuesday. Over the last week, silver prices have declined -8.38%.

Oil prices settled higher, gaining over four percent on Wednesday as traders priced in potential supply disruptions amid heightened tensions between Washington and Tehran and the lack of progress in peace negotiations between Ukraine and Russia.

Brent crude futures settled up by $2.84, or +4.21%, at $70.22 per barrel. US WTI crude futures finished up by $2.78, or +4.46%, at $65.08 per barrel. Both benchmarks recorded their highest settlement levels since 30th January, rebounding after reaching two-week lows the previous day.

Late-session rallies saw both contracts rise by more than $3, prompted by media reports that Israel had increased its alert status following indications of a potential joint attack on Iran by the US and Israel.

Over the last seven days, WTI is +0.28% and Brent is +0.80%.

On Tuesday, oil prices had declined after Iran's foreign minister announced that Tehran and Washington had reached a preliminary understanding on guiding principles for nuclear discussions. On Wednesday, the Iranian semi-official Fars news agency reported that Iran and Russia plan to conduct joint naval drills in the Sea of Oman and the northern Indian Ocean on Thursday.

Iranian state media reported a temporary closure of parts of the Strait of Hormuz — a vital oil route — due to Revolutionary Guards military exercises. The strait was closed for several hours, but it was unclear if it had fully reopened.

In Geneva, two days of peace talks between Ukraine and Russia ended on Wednesday without resolution, with President Volodymyr Zelenskiy accusing Moscow of impeding US-mediated efforts to end the ongoing four-year conflict.

The US President has repeatedly pressed Ukraine to accept a deal requiring major concessions, as Russia continues attacking its power grid and gaining ground.

The EIA report on US crude oil inventories will be published today.

US refiners set sights on direct Venezuelan oil imports amid regulatory shifts. According to a report by Reuters, US refiners Phillips 66 and Citgo Petroleum are seeking to purchase heavy crude directly from Venezuela’s state oil company, PDVSA, beginning in April, with the aim of enhancing profitability by bypassing trading houses and Chevron.

In January, Trafigura and Vitol secured the first US licences to export Venezuelan oil under a $2 billion agreement between Caracas and Washington. Chevron has operated with similar authorisation since last year. Previously, refiners sourced Venezuelan crude through these firms. However, a US general licence now allows broader oil exports from the OPEC member, potentially expanding the buyer base and increasing trade volumes to an estimated $5 billion in the coming months.

Phillips 66 is currently seeking compliance approval to transact directly with PDVSA and plans to charter tankers once authorised. Last month, it purchased Venezuelan oil from Vitol at approximately $9 per barrel below Brent. Citgo Petroleum is also negotiating direct purchases for processing at its Gulf Coast refineries, having received a cargo from Trafigura in February, its first Venezuelan import since 2019.

Valero, the second-largest US refiner, intends to buy directly from PDVSA later this year, subject to review of Venezuela’s loading infrastructure. It is increasing imports, with up to 6.5 million barrels expected for March delivery, primarily through Chevron.

Despite these developments, refiners may encounter obstacles as regulations for April deliveries are refined; US sanctions remain in place. PDVSA requires individual licences or specific US Treasury clearance for lifting cargoes and many US banks remain cautious about financing Venezuelan oil transactions.

Note: As of 5:00 pm EST 18 February 2026

Key data to move markets

EUROPE

Thursday: ECB Economic Bulletin, Eurozone Consumer Confidence, German Bundesbank Monthly Report, and speeches by ECB Board member Piero Cipollone, ECB Executive Board Vice President Luis de Guindos, and ECB President Christine Lagarde

Friday: German PPI, French, German, and Eurozone HCOB Services, Manufacturing and Composite PMIs

Monday: German IFO Business Climate, Current Assessment and Expectations and Italian CPI

Wednesday: German GDP, German GfK Consumer Confidence, Non-Monetary Policy ECB Meeting, and Eurozone’s Harmonised Index of Consumer Prices and Core Harmonised Index of Consumer Prices

UK

Friday: Retail Sales, S&P Global Services, Manufacturing and Composite PMIs

USA

Thursday: Initial and Continuing Jobless Claims, Philadelphia Fed Manufacturing Survey, Pending Home Sales, and speeches by Atlanta Fed President Raphael Bostic, Fed Governor Michelle Bowman, Minneapolis Fed President Neel Kashkari, Chicago Fed President Austan Goolsbee, and San Francisco Fed President Mary Daly

Friday: CPI, Core CPI, GDP, Personal Consumption Expenditures, Personal Income, Personal Spending, S&P Global Services, Manufacturing and Composite PMIs, Michigan Consumer Expectations, Michigan Consumer Sentiment Index, UoM 1- and 5-year Consumer Inflation Expectations, New Home Sales, Fed Monetary Policy Report, and speeches by Chicago Fed President Austan Goolsbee and Atlanta Fed President Raphael Bostic

Monday: Factory Orders

Tuesday: ADP Employment Change 4-week Average, Consumer Confidence, and a speech by San Francisco Fed President Mary Daly

Wednesday: A speech by St Louis Fed President Alberto Musalem

JAPAN

Thursday: National CPI and Core CPI

Tuesday: Exports, Imports, Merchandise Trade Balance, and Adjusted Merchandise Trade Balance

CHINA

Thursday: PBoC Interest Rate Decision

Global Macro Updates

Preview: PCE index. The Bureau of Economic Analysis will release the December PCE report on Friday, delayed by the government shutdown backlog, alongside the advance Q4 GDP estimate. Consensus calls for headline PCE to hold at 2.8% y/o/y, while core PCE, the Fed's preferred gauge, is forecast to edge up to 2.9% y/o/y on a 0.3% m/o/m increase, with firmer goods and services as dual drivers. If December's print confirms the re-acceleration, it would validate the FOMC's decision to pause its easing cycle and likely push the first rate cut to mid-2026 at the earliest.

The data lands amid an earnings season that has laid bare the K-shaped consumer. Walmart reports Q4 today, with forecasts showing 4.35% same-store sales growth, $0.73 EPS, and $190.491 billion in revenue, up 5.5% y/o/y. Bottom line growth is set to outpace top line gains. Key areas to watch are higher-income consumer spending trends, with a particular focus on trade-down, e-commerce profitability, and management's guidance on the 2026 consumer outlook.

In contrast, Kraft Heinz, which last week guided 2026 earnings below consensus, announced a $600 million reinvestment to revive stagnating volumes and shelved its planned corporate split. Procter & Gamble's Q4 earnings similarly showed flat organic sales and a volume decline of one percent across three of five segments, even as its beauty division, a more discretionary, premium category, grew volumes 3.1%.

According to TD Economics, credit card data show lower-income households grew spending just 0.4% y/o/y in December, versus 2.4% for higher earners. With the personal saving rate at 3.5%, the lowest since 2022, aggregate consumption is increasingly reliant on wealth effects and balance-sheet flexibility rather than income growth. Friday's PCE report will assess the resilience of current expectations as inflation remains more persistent than anticipated by the markets.

FOMC minutes. The minutes from the January meeting of the FOMC reflect a prudent stance among policymakers, emphasising that progress towards the inflation target may prove gradual.

The release contained no significant surprises. As anticipated, the January meeting concluded with rates unchanged, although Governors Waller and Miran dissented, advocating for a 25 bps reduction. The overall tone of the policy statement was interpreted as somewhat hawkish.

The majority of members cautioned that reaching the 2% inflation target could be slower and more uneven than previously expected, with a material risk of inflation remaining above target. Elevated inflation was attributed primarily to higher core goods prices resulting from tariffs, although the majority anticipate these effects to diminish over the course of the year.

On the labour market, officials acknowledged subdued job gains, but observed that conditions are beginning to stabilise following a period of cooling, with downside risks to employment now easing.

Officials assessed that the economy is expanding at a solid pace, buoyed by resilient consumer spending and robust business investment, particularly in AI. The outlook for growth in January was stronger than in December.

The minutes underscored the Fed’s cautious and data-driven approach to policy. Some members advocated maintaining current rates until the inflation outlook becomes more definitive.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here. Trading financial instruments involves significant risk of loss and may not be suitable for all investors. Past performance is not a reliable indicator of future performance.