Key data to move markets today

China: Caixin Manufacturing PMI.

EU: Spanish, Italian, French, German and Eurozone’s HCOB Manufacturing PMIs, Eurozone Unemployment Rate, and speeches by ECB President Christine Lagarde, and ECB’s executive board members Isabel Schnabel and Piero Cipollone.

US Stock Indices

Dow Jones Industrial Average -0.20%.

Nasdaq 100 -1.22%.

S&P 500 -0.64%, with 5 of the 11 sectors of the S&P 500 down.

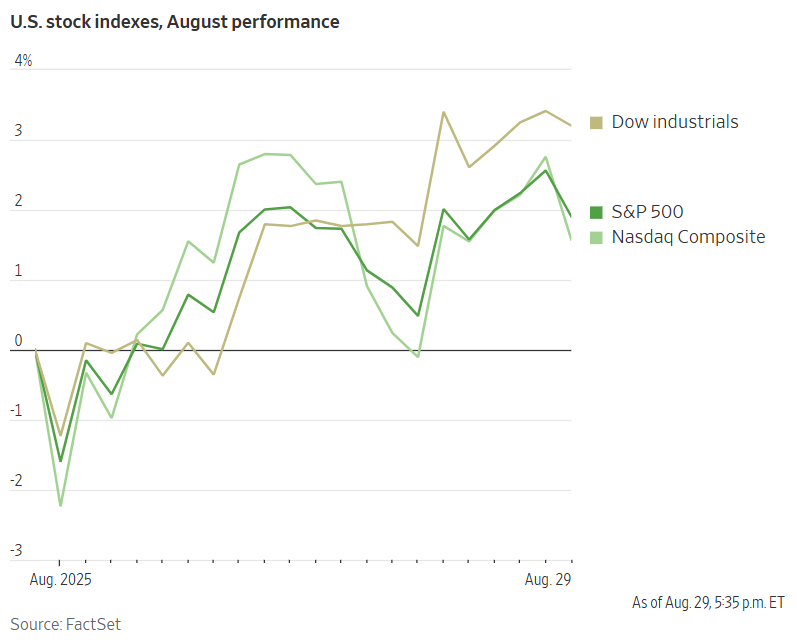

Despite a sell-off in AI-related shares on Friday, US stocks concluded the month with gains. The S&P 500 advanced by +1.91% in August, achieving five of its 20 record highs for the year. The Nasdaq Composite also climbed by +1.58%, while the Dow Jones Industrial Average saw a +3.20% increase.

All three indices were surpassed by the Russell 2000, which tracks small- and mid-sized companies, registering a +7.00% monthly increase. These firms, which have historically been more vulnerable to higher interest rates, are now appearing more attractive to investors, leading to a strong performance for the index.

The stock market appeared to disregard the potential for future inflation, which economists suggest could result from a Fed that is unduly influenced by the White House and lowers interest rates excessively. If August was any indication, the stock market views that possibility as tomorrow’s problem.

According to LSEG I/B/E/S data, y/o/y earnings growth for the S&P 500 in Q2 is projected to be +13.2%. This number jumps to 15.2% when excluding the Energy sector. Of the 489 companies in the S&P 500 that have reported earnings to date for Q2 2025, 79.6% have reported earnings above analyst estimates, with 79.2% of companies reporting revenues exceeding analyst expectations. The y/o/y revenue growth is projected to be 6.3% in Q2, increasing to 7.5% when excluding the Energy sector.

Information Technology, at 93.8%, is the sector with most companies reporting above estimates, while Communication Services, with a surprise factor of 12.1%, is the sector that’s beaten earnings expectations by the highest surprise factor. Within Materials, 50.0% of companies have reported below estimates, and Real Estate at -0.6% is the sector with the lowest surprise factor. The S&P 500 surprise factor is 7.8%. The forward four-quarter price-to-earnings ratio (P/E) for the S&P 500 sits at 22.9x.

In corporate news, the Commerce Department announced on Friday that it would alter a licensing system that allows Samsung Electronics and SK Hynix to acquire US equipment for their semiconductor plants in China. This decision is aimed at increasing the difficulty for these two key South Korean firms to operate in the region and may complicate ongoing trade discussions between the US and South Korea. The change could also negatively impact US semiconductor equipment companies such as Applied Materials and KLA, which count Samsung and SK Hynix as significant customers.

Kraft Heinz is reportedly nearing a plan to split up, according to a Friday report from The Wall Street Journal.

Super Micro Computer issued a warning that existing weaknesses in its financial disclosure controls, if not addressed, could impede the company's ability to report results ‘in a timely and accurate manner.’

Caterpillar has revised its financial outlook, now projecting that tariffs will have a greater impact on its business than previously estimated, potentially costing the company as much as $1.8 billion this year. This warning comes just three weeks after its last quarterly report.

Clothing retailer Gap has also increased its forecast for the financial impact of tariffs, now expecting them to cost the company up to $175 million in the current fiscal year.

S&P 500 Best performing sector

Health Care +0.73%, with Cooper Companies +4.36%, Molina Healthcare +3.50%, and Elevance Health +2.65%.

S&P 500 Worst performing sector

Information Technology -1.63%, with Dell Technologies -8.88%, Oracle -5.90%, and Super Micro Computer -5.53%.

Mega Caps

Alphabet +0.55%, Amazon -1.12%, Apple -0.18%, Meta Platforms -1.65%, Microsoft -0.58%, Nvidia -3.34%, and Tesla -3.50%.

Information Technology

Best performer: Autodesk +9.09%.

Worst performer: Dell Technologies -8.88%.

Materials and Mining

Best performer: Eastman Chemical +3.17%.

Worst performer: Mosaic -1.62%.

European Stock Indices

CAC 40 -0.76%.

DAX -0.57%.

FTSE 100 -0.32%.

Commodities

Gold spot +0.82% to $3,446.75 an ounce.

Silver spot +1.54% to $39.67 an ounce.

West Texas Intermediate -0.37% to $64.01 a barrel.

Brent crude -0.31% to $68.12 a barrel.

Gold prices increased more than half a percent on Friday, positioning the precious metal for its strongest monthly performance since April. This surge was driven by new US inflation data, which strengthened expectations that the Fed may cut interest rates this month.

Spot gold rose by +0.82% to $3,446.75 per ounce, reaching its highest level since 17th July. Over the course of August, bullion prices increased by +4.77%. Concurrently, the US dollar remained steady on Friday but was on track for a monthly decline of -2.19%, which makes gold more affordable for international buyers.

The rise in gold prices followed a solid increase in US consumer spending in July, coupled with a pickup in underlying inflation. The latter was attributed to tariffs on imports that raised the prices of certain goods.

Gold, which does not yield interest, often performs well in an environment of low interest rates, which further explains the recent price appreciation.

On Friday, oil prices dropped as traders anticipated weaker demand in the US, the world's largest oil market, along with a projected increase in supply this autumn from OPEC+.

Brent crude futures for October delivery, which expired on Friday, settled at $68.12 a barrel, a decrease of 21 cents or -0.31%. The more actively traded November contract closed down 53 cents, or -0.78%, at $67.45. Similarly, WTI crude futures fell by 24 cents, or -0.37%, to $64.01.

Both benchmarks concluded August decidedly lower, with WTI dropping by -7.57% and Brent by -6.11%. This market shift was partially in anticipation of the upcoming OPEC+ meeting.

Markets were in part shifting their focus toward next week's OPEC+ meeting. Crude output from OPEC+ has been increasing as the group accelerates production hikes to regain market share, raising the overall supply outlook and putting downward pressure on global oil prices.

The end of the US summer driving season, marked by the Labor Day holiday on Monday, signaled the conclusion of the peak demand period in the largest fuel market. While prices had risen earlier in the week due to Ukrainian attacks on Russian oil export terminals, reports of potential ceasefire talks among Ukraine's European allies helped stabilise and lower prices.

Despite these factors, US crude inventories for the week ending 22nd August showed larger-than-expected draws, suggesting that late-summer demand remained solid, particularly within the industrial and freight sectors.

Note: As of 5 pm EDT 29 August 2025

Currencies

EUR +0.04% to $1.1684.

GBP -0.03% to $1.3503.

Bitcoin -3.24% to $108,469.22.

Ethereum -2.77% to $4,366.05.

The US dollar weakened against the euro and the Swiss franc on Friday, concluding August with a -2.19% decline. This movement occurred as traders increasingly prepared for a potential interest rate cut by the Fed this month.

After initially strengthening following the release of US inflation data that met expectations, the dollar later surrendered these gains, extending its three-day losing streak. On Friday afternoon, the dollar index was down -0.04% at 97.86.

The foreign exchange market's reaction to recent trade policy announcements and developments from the Fed appears to be muted. This could be attributed to the illiquid nature of summer markets or to the market's expectation that any changes by the Fed will initiate a rate-cutting cycle already priced in by the market. This reinforces the view that future currency movements will be highly dependent on upcoming economic data.

Against the dollar, the euro was up +0.04% at $1.1684 and sterling was -0.03% lower at $1.3503. Both currencies appreciated against the US dollar over the course of the month, with the euro gaining +2.34% and sterling rising +2.27% in August.

Against the Japanese yen, the dollar edged up by +0.06% to ¥147.02, though it was down -2.44% for the month of August. The dollar also weakened against the Swiss franc by -0.26% to 0.7997, and declined -1.30% for the month.

Fixed Income

US 10-year Treasury +2.5 basis points to 4.233%.

German 10-year bund +2.9 basis points to 2.727%.

UK 10-year gilt +2.2 basis points to 4.724%.

US Treasuries showed mixed performance on Friday, with the two-year yield, particularly sensitive to interest rates, poised for its largest monthly decline in a year. This occurred as traders adjusted their positions before today's Labor Day holiday and following the release of July inflation data that aligned with economists' forecasts.

According to data released on Friday, the Personal Consumption Expenditures (PCE) Price Index increased by 0.2% m/o/m, following an unrevised 0.3% rise in June. Excluding the more volatile food and energy components, the Core PCE Price Index also increased by 0.3%, matching the rise from the previous month. This data keeps the Fed on track for a potential rate cut at its FOMC 16th - 17th September meeting.

Yields on longer-dated bonds edged higher on Friday as traders closed out positions ahead of the long weekend and repositioned for the end of the month. This was likely influenced by interest rate hedging, as corporate debt markets are expected to become more active this week.

The 2-year note yield was down -1.6 bps on the day at 3.625%, marking a -33.8 bps drop for August — the largest since last August.

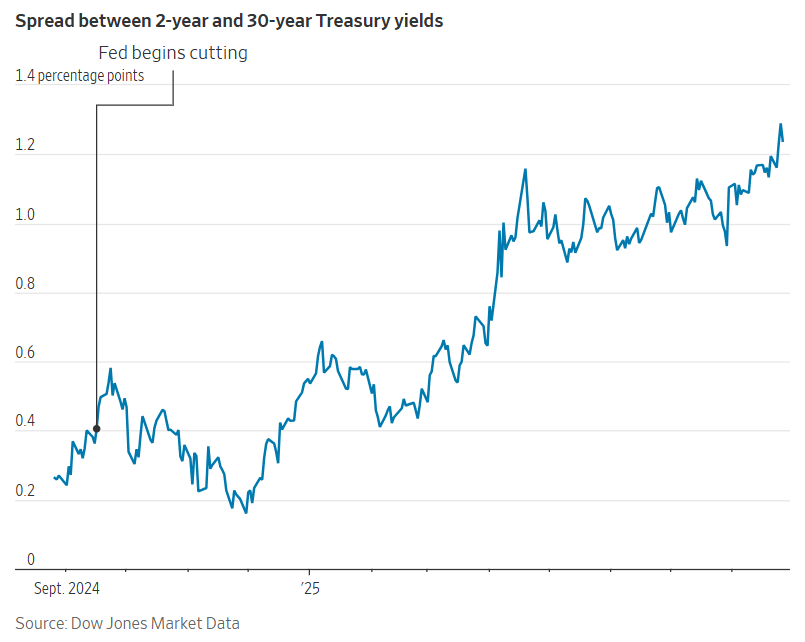

The yield on 10-year notes rose by +2.5 bps to 4.233%, but still finished August -14.2 bps lower. The yield curve between two-year and 10-year notes stood at 60.8 bps, having steepened by 19.6 bps in August, its most significant change since April.

The 30-year yield increased by +5.1 bps on Friday, ending the month +3.0 bps higher. This contributed to the yield curve between two-year and 30-year notes steepening by 36.8 bps in August to 130.4 bps.

Recent efforts by the US President to fire Fed Governor Lisa Cook have raised the possibility that the administration could appoint more dovish members to the Fed, which could lead to an easier policy stance. A court hearing on the attempt to remove Cook concluded on Friday with no immediate ruling, meaning she will remain in her position for now.

The US bond market will be closed today in observance of the US Labor Day holiday.

Fed funds futures traders are now pricing in a 87.6% probability of a rate cut in September, up from 84.7% last week and 37.7% on 31st July, according to CME Group's FedWatch Tool. Traders are currently anticipating 56.1 bps of cuts by year-end, higher than the 55.7 bps expected last week, and the 32.7 bps expected on 31st July.

Across the Atlantic, eurozone bond yields edged higher on Friday, with 30-year bond yields poised for their largest monthly increase in five months. This movement reflects a broader trend of pressure on long-dated debt across developed economies, driven by investor concerns regarding the sustainability of high government debt levels.

Germany's 30-year yield, which reached its highest level since 2011 earlier in the month, rose by +15.7 bps in August, marking its most significant monthly gain since March. On Friday, the yield was up by +3.8 bps at 3.337%.

The most substantial monthly rise occurred in France, where 30-year yields increased by +28.7 bps to 4.423%, also the largest rise since March. While French bonds were unsettled earlier in the week by Prime Minister François Bayrou's call for a confidence vote on 8th September — a vote he may lose — the market remained calm on Friday.

The spread of French 10-year yields over Germany’s was slightly higher on Friday, increasing by 0.1 bps to 78.7 bps on Friday, contributing to a 13.2 bps rise in August.

France's 10-year yield rose by +3.0 bps to 3.514% on Friday, contributing to a monthly increase of +16.3 bps. Germany's 10-year yields increased by +2.9 bps to 2.727% on Friday, recording a more modest monthly increase of +3.1 bps. If Bayrou were to lose the confidence vote, France would face the prospect—for the third time in 12 months—of being without a prime minister or a national budget.

Italy's 10-year yield was also in line with its European peers on Friday, rising by +4.1 bps to 3.587%, contributing to an +8.0 bps increase in August. The spread of 10-year BTPs over 10-year Bunds stood at 86.0 bps, widening 4.9 bps through August.

Two-year yields, which are sensitive to ECB policy, were largely unchanged. Germany's two-year yield rose by +1.5 bps to 1.951% but fell by -2.0 bps for the month of August.

Note: As of 5 pm EDT 29 August 2025

Global Macro Updates

July core and headline PCE in line with expectations. Based on the latest economic data for July, the Core Personal Consumption Expenditures (PCE) price index rose by 0.3% m/o/m, aligning with consensus forecasts and matching the unrevised 0.3% gain from June. This increase represents the fourth consecutive monthly rise and the most significant since January. On an annual basis, core PCE inflation accelerated to 2.9% y/o/y, which was in line with expectations and slightly up from June's 2.8% rate.

The headline PCE index increased by 0.2% for the month, also meeting expectations but reflecting a slight cooling from June’s 0.3% advance. The annualised headline inflation rate held steady at 2.6%, consistent with both forecasts and the prior month's reading.

Regarding consumer activity, personal spending grew by a solid 0.5% m/o/m, meeting expectations and surpassing June's upwardly revised 0.4% increase. Concurrently, personal income rose by 0.4%, slightly below the anticipated 0.5% gain, while the previous month's 0.3% reading was left unchanged.

These figures were released after sell-side economists had raised their PCE forecasts in response to higher-than-expected Consumer Price Index (CPI) and Producer Price Index (PPI) data reported earlier for July.

Final August consumer meets consensus, inflation expectations rise. The final US consumer sentiment reading for August registered at 58.2, falling short of the consensus forecast of 58.6 and declining from July's final figure of 61.7. A key driver of this downturn was a resurgence in inflation fears, as year-ahead inflation expectations increased to 4.8% from 4.5% in the prior month. Similarly, long-run inflation expectations edged up to 3.5% from 3.4%. Notably, the August data ended a two-month trend of receding short-run inflation expectations and a three-month trend for long-run expectations.

The drop in overall sentiment was reflected across the report's primary components. The Current Economic Conditions index fell m/o/m from 68.0 to 61.7, while the Index of Consumer Expectations declined from 57.7 to 55.9. The report highlighted that consumers' assessment of buying conditions for durable goods subsided to its lowest level in a year. Furthermore, perceptions of current personal finances declined by 7%, a drop attributed to heightened concerns over high prices.

Federal court rules Trump exceeded authority with signature tariff policy. In a significant ruling late Friday, a federal appeals court invalidated the Trump administration's signature tariffs, concluding that the president had exceeded the authority granted by emergency powers to reshape US trade policy. The 7-4 decision from the US Court of Appeals for the Federal Circuit upheld a lower-court ruling that challenges a core component of President Trump’s economic agenda.

The majority found that the president overstepped his authority under the 1977 International Emergency Economic Powers Act (IEEPA). The court determined that the ‘unheralded’ and ‘transformative’ nature of the tariff policy triggered the ‘major questions doctrine’—a legal standard used when an executive action is seen as reaching far beyond the regulatory power granted by Congress. The ruling did not break along partisan lines, as judges appointed by presidents of both parties were on each side of the decision.

This ruling represents a setback for a key policy of Trump’s second term and sets the stage for an appeal to the Supreme Court. The appeals court has allowed the tariffs to remain in place through mid-October, providing time for such an appeal to be filed. The levies voided by the decision include baseline 10% tariffs on nearly all countries, as well as higher tariffs on nations the administration considers unfair trading partners, such as Canada, China, and Mexico.

However, the ruling’s impact is limited, as it does not affect all of the administration's tariffs. Levies imposed on specific industries—including automobiles, steel, aluminum, and copper—under a separate national security authority remain in place. The administration reportedly plans to expand these unaffected tariffs, partly as a contingency should the IEEPA tariffs be permanently overturned.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here. Trading financial instruments involves significant risk of loss and may not be suitable for all investors. Past performance is not a reliable indicator of future performance.