Key data to move markets today

EU: Italian CPI, German ZEW surveys on Economic Sentiment and Economic Situation, Eurozone Industrial Production, Eurozone ZEW Survey on Economic Sentiment, and speeches by Governor of the Banque de France François de Villeroy de Galhau and Governor of the Bank of Spain José Luis Escrivá

UK: Average Earnings, Claimant Count Change and Rate, Employment Change, and ILO Unemployment Rate

USA: Retail Sales, Retail Sales Control Group, and Industrial Production

JAPAN: Exports, Imports, Merchandise Trade Balance and Adjusted Merchandise Trade Balance

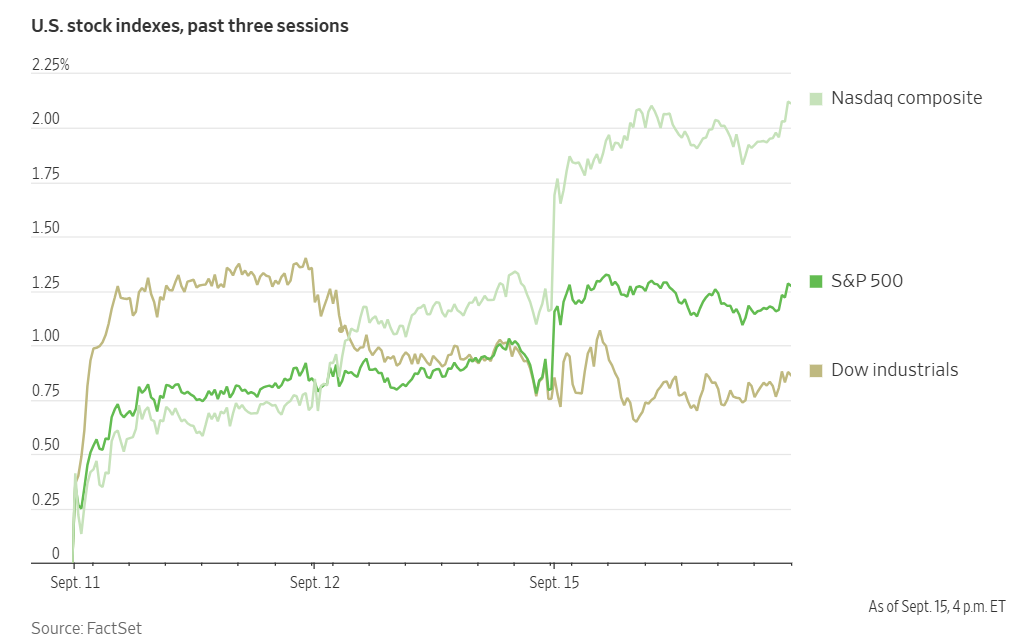

US Stock Indices

Dow Jones Industrial Average +0.11%

Nasdaq 100 +0.84%

S&P 500 +0.47%, with 5 of the 11 sectors of the S&P 500 up

US stocks advanced on Monday, driven by a broader market rally for technology companies and signs of thawing relations in the economic standoff between the US and China.

The S&P 500 rose by +0.47% to reach its 25th closing record this year at 6,615.28, while the Nasdaq Composite finished at its 26th high of the year at 22,348.75. With yesterday’s positive performance of +0.84%, the Nasdaq 100 has experienced its longest winning streak since 2023.

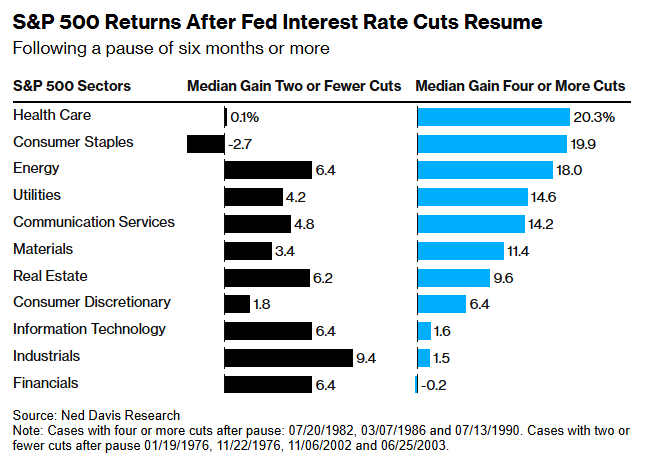

Investors are awaiting the results of the FOMC meeting which starts today. Historical data from Ned Davis Research suggests that in past cycles where the Fed delivered only one or two rate cuts after a pause, a strong economy often led to outperformance in cyclical sectors like financials and industrials. Conversely, in cycles requiring four or more cuts, the economy tended to be weaker, with defensive sectors such as Healthcare and Consumer Staples yielding the highest median returns.

Data going back to the 1970s also indicates that the S&P 500 has, on average, been 15% higher one year after the resumption of rate cuts following a pause of six months or more. This is a stronger performance compared to the average 12% gain seen in the same period after the first cut of a typical cycle.

In corporate news, China's antitrust regulator ruled that Nvidia violated anti-monopoly laws in a high-profile 2020 deal. This will increase pressure on Washington during sensitive trade negotiations.

The US FTC is investigating Live Nation's Ticketmaster to determine if the company has taken adequate measures to prevent bots from illegally reselling tickets on its platform.

CoreWeave announced that its shareholder, Nvidia, has agreed to purchase $6.3 billion worth of cloud services. This deal is part of a broader effort to accelerate the adoption of artificial intelligence across the economy.

Alaska Air Group anticipates its adjusted third-quarter profit to be at the low end of its previous estimate of $1.00 to $1.40 per share. The company attributed the projected drop to a technology outage in July and rising fuel prices.

Exxon Mobil is launching a new programme to encourage more retail investors to support the company in proxy votes. The programme features an automatic system that could limit the influence of activist shareholders.

S&P 500 Best performing sector

Communication Services +2.33%, with Alphabet +4.30%, Warner Bros. Discovery +3.13%, and News Corp +2.26%

S&P 500 Worst performing sector

Consumer Staples -1.15%, with J M Smucker -5.16%, McCormick & Company -4.35%, and Kenvue -3.90%

Mega Caps

Alphabet +4.30%, Amazon +1.44%, Apple +1.12%, Meta Platforms +1.21%, Microsoft +1.07%, Nvidia -0.04%, and Tesla +3.56%

Information Technology

Best performer: Seagate Technology Holdings +7.72%

Worst performer: Texas Instruments -2.41%

Materials and Mining

Best performer: Albemarle +6.66%

Worst performer: Corteva -5.68%

European Stock Indices

CAC 40 +0.92%

DAX +0.21%

FTSE 100 -0.07%

Commodities

Gold spot +0.97% to $3,677.99 an ounce

Silver spot +1.28% to $42.71 an ounce

West Texas Intermediate +1.09% to $63.28 a barrel

Brent crude +0.85% to $67.45 a barrel

Gold reached a new peak on Monday, supported by a softer dollar and expectations of lower Treasury yields. Spot gold was +0.97% to $3,677.99 per ounce, following an earlier session high of $3,685.39. The dollar index dropped -0.22% to a one-week low, which increased gold's appeal to buyers using other currencies.

Additionally, strong buying was prompted by weekend reports that China might relax its gold import and export regulations. This rally in gold prices is being driven by strong demand from both official and private sectors.

Oil prices closed higher on Monday as investors assessed the effects of Ukrainian drone strikes on Russian refineries and calls from the US president for NATO nations to stop buying Russian oil.

Brent crude futures rose by $0.57, or +0.85%, to settle at $67.45 a barrel. WTI crude increased by $0.68, or +1.09%, to settle at $63.28 a barrel. Both contracts saw gains of over one percent last week as Ukraine intensified its attacks on Russian oil infrastructure.

A crucial processing unit at Russia's Kirishi refinery - one of the country's largest - was halted after a drone strike. This refinery processes roughly 355,000 barrels of Russian crude per day, which accounts for 6.4% of the country’s total.

The US president stated that the US would be prepared to impose new energy sanctions on Russia, but only if all NATO nations stopped purchasing Russian oil and implemented similar measures.

Oil also found some support from strong refinery demand in China and a decrease in US crude inventories. However, weaker economic data from China slightly tempered these gains.

Note: As of 5 pm EDT 15 September 2025

Currencies

EUR +0.26% to $1.1764

GBP +0.33% to $1.3601

Bitcoin -0.33% to $115,505.59

Ethereum -2.73% to $4,525.30

The US dollar weakened across the board on Monday as investors await the FOMC rate decision tomorrow. The Fed is widely expected to resume its monetary easing cycle at this meeting. Investors will be focussed on the extent of any cut and the FOMC’s interpretation of current and near future conditions.

The dollar index was -0.22% to a near one-week low of 97.33. Against the Japanese yen, the dollar fell by -0.22% to ¥147.33, while the euro gained +0.26% to reach $1.1764. The pound sterling also strengthened, rising +0.33% to $1.3601, its highest level since early July.

The euro's resilience is supported by expectations of a more dovish Fed policy and the reduced likelihood of further rate cuts from the ECB. This is reflected in speculative net long positions on the euro against the dollar, which reached nearly a two-year high of $18.4 billion for the week ending 8th September. The euro showed little reaction to Fitch Ratings' recent downgrade of France's sovereign credit score from AA- due to concerns about the government's rising debt. The market had already largely priced in this downgrade, minimising its impact on the currency.

Investors are also closely watching interest rate decisions from central banks in Japan, Britain, Canada, and Norway. While both the BoE and BoJ are expected to keep their rates unchanged, traders will be monitoring the BoE's plans to slow its bond reduction programme and the BoJ's commentary for any hints of a potential rate hike later this year.

Fixed Income

US 10-year Treasury -2.6 basis points to 4.044%

German 10-year bund -2.2 basis points to 2.694%

UK 10-year gilt -4.1 basis points to 4.635%

US Treasury yields fell across the curve on Monday, driven by a weaker-than-expected manufacturing report from New York as investors await the Fed's policy announcement tomorrow.

The yield on the 10-year Treasury note was -2.6 bps to 4.044%, marking its third decline in four sessions. The yield on the 30-year bond was -2.0 bps to 4.663%. The two-year Treasury yield, highly sensitive to Fed interest rate expectations, was also down, falling -1.7 bps to 3.545%.

The spread between the two- and 10-year Treasury yields narrowed slightly to 49.9 bps from 50.8 bps the previous day.

The decline in yields was largely in response to the New York Fed's Empire State manufacturing index, which registered at a negative 8.7 for September. This reading was the first below zero since June and fell short of economists' forecast of 5.0.

Fed funds futures traders are now pricing in a 96.0% probability of a 25 bps rate cut this week, up from 93.0% last week. The probability of a 50 bps rate cut at this meeting is now priced in at 4.0%, down from 7.0% last week, according to CME Group's FedWatch Tool. Traders are currently anticipating 67.9 bps of cuts by year-end, slightly higher than the 67.8 bps expected last week.

Across the Atlantic, eurozone government bonds fell on Monday in a week filled with major monetary policy announcements, including interest rate decisions from the Fed, BoJ, and BoE.

German bond yields declined, with the 10-year yield -2.2 bps to 2.694%. The two-year yield was -1.7 bps to 2.020%. On the long-end, the 30-year yield was -3.6 bps to 3.258%.

French bonds traded largely in line with their German counterparts, recovering from an early lag that followed Fitch's downgrade of France's long-term credit rating on Friday.

The yield spread between safe-haven German Bunds and 10-year French government bonds was at 80.1 bps. OATs appear to be already trading at a significant discount compared to other bonds with similar credit ratings.

Italian sovereign bonds outperformed, with the 10-year yield falling -4.5 bps to 3.481%.

Borrowing costs had risen Friday after the ECB maintained a positive outlook on growth and inflation. However, markets are currently pricing in a 40% chance of a 25 basis point ECB rate cut by June 2026, which would bring the rate to 1.75%. Markets are also anticipating the deposit facility rate to be around 1.95% by December 2026.

Note: As of 5 pm EDT 15 September 2025

Global Macro Updates

September Empire State Index: new orders and shipments see significant decline. The Empire State Manufacturing Survey for September recorded a significant decline, with the index falling 21 points to -8.7. This marked the first negative reading since June 2025 and was well below the consensus forecast of +5.0 and August's +11.9.

This downturn was reflected in several key components of the survey. New orders fell sharply on a m/o/m basis to -19.6 from +15.4, while shipments declined to -17.3 from +12.2. These are the lowest levels for both indexes since April 2024. Employment also registered a drop to -1.2 from +4.4, indicating that job levels were largely flat following three consecutive months of increases. While the pace of input price increases remained high, it was slower than the previous month, with the prices paid index decreasing to +46.1 from +54.1. The pace of selling price increases was more moderate, as prices received fell to +21.6 from +22.9. Furthermore, inventories rose to -4.9 from -6.4.

Looking ahead, the report noted that firms anticipate some improvement in conditions over the coming months, though optimism remains subdued. Employment levels are expected to be flat over the next six months.

Miran confirmed to Fed as Court shields Governor Cook. On Monday evening, in a 48-47 vote that proceeded largely along party lines, the Senate confirmed the US President’s economic adviser, Stephen Miran, to the Federal Reserve board. Miran is expected to join the Fed on Tuesday, just in time for a crucial FOMC meeting.

Republicans fast-tracked the confirmation amid pressure from the administration for the Fed to lower interest rates. Miran, who has chaired the White House Council of Economic Advisers, will take unpaid leave to join the Fed. The duration of his tenure remains uncertain; he could be nominated for a full 14-year term in February, be replaced by another nominee, or continue serving indefinitely if the position remains unfilled.

In a separate development, a US appeals court on Monday evening declined to permit the administration to dismiss Fed Governor Lisa Cook. This attempted dismissal marks the first time a US president has taken such an action since the Fed's establishment in 1913. The decision by the US Court of Appeals for the District of Columbia Circuit leaves the administration with a narrow window to appeal to the Supreme Court if it intends to stop Cook from attending this week's policy meeting.

The DC Circuit denied the Justice Department's request to stay a lower court's temporary order that blocked the president from removing Cook, an appointee of former President Joe Biden. On 9th September, US District Judge Jia Cobb ruled that the administration's allegations against Cook were unlikely to constitute sufficient grounds for removal under federal law.

The appeals court's 2-1 decision noted that Cook would likely succeed in her claim that she was denied due process under the Fifth Amendment, as the government did not provide her with adequate notice or an opportunity to respond to the allegations. The Fed has not commented on the ruling but has stated it will follow any court decision and has urged a swift resolution.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here. Trading financial instruments involves significant risk of loss and may not be suitable for all investors. Past performance is not a reliable indicator of future performance.